by FinTech App Development Compan

FinTech App Development Services

As a premier Fintech app development company, we empower businesses to optimize their financial processes and transactions to enhance productivity, concentrate on revenue generation, and deliver value to their clients. Our extensive financial industry knowledge enables us to utilize technology to offer unmatched custom FinTech mobile app development solutions.

We Possess Expertise in Secure and Scalable Fintech App Development Solutions

With over 12 years of expertise in developing fintech applications, we focus on creating secure, scalable, high-performance solutions tailored to your business requirements. Supported by a team of over 150 skilled fintech developers, we have successfully launched over 100 innovative fintech applications across more than 20 countries. Whether you require a solid digital banking system, an efficient payment gateway, or an AI-driven investment application, we prioritize compliance, security, and innovation at every phase. Our knowledge enables both startups and established enterprises to remain ahead in the rapidly changing financial environment.

Years of

Experience

0

+

Fintech App

Developers

0

+

Fintech App

Solutions Delivered

0

+

Customer Retention

Rate

0

%

Let’s hire dedicated Financial app developers for Your Project!

Finance App Development Services We Offer

Loan Lending Mobile App Development

Streamline the lending process with our intelligent loan lending applications. We develop secure, AI-enhanced platforms that simplify loan applications, approvals, and disbursements, making it easier for your clients to borrow.

Expense tracker app development

Gain control over your finances with an easy-to-use expense tracker application. Our solutions provide automated categorization, budgeting insights, and real-time analytics to effortlessly assist users in managing their spending.

Personal finance app development

Help users reach their financial objectives with a personal finance application. We create apps loaded with features that offer tailored insights and tools for financial planning, ranging from budgeting to investment tracking.

Cross Platform Finance App Development

Broaden your audience with a cross-platform finance application. Our developers craft seamless, high-performance apps that function flawlessly on iOS, Android, and the web, ensuring accessibility for all users..

Digital Wallet App

Development

Facilitate quick and secure transactions with a digital wallet application. We design comprehensive wallets capable of handling payments, peer-to-peer transfers, bill payments, and cryptocurrency transactions, all with top-notch security.

.

Mobile Banking App Development

Provide effortless banking experiences with our mobile banking application solutions. We incorporate features like fund transfers, bill payments, account management, and biometric security for a safe and user-friendly experience.

Trading App Development Services

Revolutionize stock trading with a sophisticated trading application. We create platforms featuring real-time market information, AI-driven insights, and secure transactions to empower users to trade stocks, forex, and cryptocurrencies confidently.

KYC App

Development

Make identity verification easier with a reliable KYC application. Our solutions utilize AI-powered document scanning, facial recognition, and compliance automation to streamline the onboarding process while ensuring adherence to regulations.

Fintech Web App Development

Establish a strong online presence with a scalable FinTech web application. Whether for banking, payments, or investment platforms, we develop secure and user-friendly web solutions that transform financial services.

We incorporate advanced technologies into our Fintech application development solutions

AI/ML

Integration

We utilize the capabilities of Artificial Intelligence and Machine Learning to develop intelligent fintech solutions that boost automation, enhance decision-making, and provide personalized user experiences. Our AI-driven methodology ensures more intelligent financial services, ranging from fraud detection to predictive analytics.

Blockchain Technology

Our fintech solutions utilize blockchain technology to provide security, transparency, and efficiency in financial transactions. By implementing decentralized ledgers and smart contracts, we remove intermediaries, lower costs, and build trust in digital payments and asset management.

Internet of

Things

Through the integration of IoT with fintech, we facilitate real-time data gathering and smooth financial interactions across connected devices. Whether it involves smart payments, risk evaluation, or asset tracking, our solutions improve convenience and security within the financial ecosystem.

Data Analytics

We convert raw financial data into useful insights by leveraging advanced analytics. Our fintech solutions assist businesses in identifying patterns, refining strategies, and making informed decisions based on data, leading to enhanced risk management and customer engagement.

Cloud Computing

Our cloud-based fintech applications are defined by scalability, security, and flexibility. We provide effortless access to financial services, efficient data storage, and real-time processing while ensuring compliance and cost-efficiency for organizations.

AR, VR and XR

We introduce innovation into fintech by offering immersive experiences through Augmented Reality (AR), Virtual Reality (VR), and Extended Reality (XR). From virtual financial advisory services to interactive banking solutions, our technology transforms user engagement and accessibility.

Industries We Work In

Food and Restaurant

Education

Aviation

Healthcare

Agriculture

Sports

Information Technology

Gaming

Construction

Fintech

Taxi booking

Events or Media

Petroleum

Real Estate

Fitness

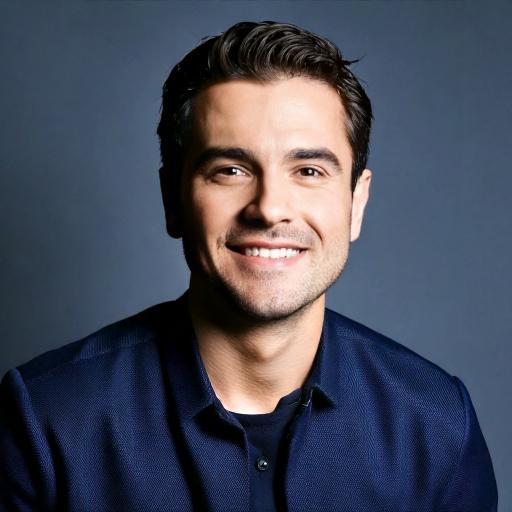

Reviews from Our Clients

“We required a reliable Fintech application capable of managing high transaction volumes seamlessly, but our earlier developers consistently failed to meet deadlines and delivered problematic code. Next Olive completely transformed our experience. Their team not only grasped our needs but also proposed innovative features we hadn’t considered. The application they created is secure, scalable, and offers an uninterrupted user experience. Our customer satisfaction has surged, and transaction processing is now 40% quicker!”

Clint Johnson, IsraelFounder

“Our primary challenge was the integration of numerous payment gateways into our Fintech platform while ensuring both security and efficiency. Next Olive’s expertise made the entire integration process effortless. They designed a strong solution that guarantees smooth transactions while upholding top-notch security standards. Since we launched the upgraded platform, we’ve experienced a notable decrease in payment failures and a 30% rise in user engagement!”

Tony Parker, UKDirector

“We encountered significant compliance challenges with our current Fintech application, which exposed us to potential regulatory fines. Next Olive arrived with a strategic action plan, overhauled our security protocols, and ensured we fully aligned with industry regulations. Their team was proactive, communicative, and exceptionally efficient. As a result, we are now fully compliant, and our application has earned the confidence of both regulators and users.”

Dustin Handerson, FranceCEO

Previous

Next

Reach Out To US Today!

We Integrate Popular Features into Our Fintech App Development Solutions

Account Management

Easily oversee your finances using our fintech application. Check account balances, monitor transactions, and establish spending limits, all from a single platform. Maintain control over your finances with live updates and straightforward access to your financial information.

Digital Payments

Quickly transfer and receive money with our reliable digital payment solutions. Pay bills, share expenses, and shop online effortlessly. With various payment methods and seamless connections, transactions are smooth and hassle-free.

Budgeting Tools

Gain control over your expenses with intelligent budgeting features. Set financial objectives, categorize your spending, and gain insights into your expenditure patterns. Our app assists you in staying on track and making knowledgeable financial choices.

Investment Options

Enhance your wealth through a variety of investment choices. From stocks and mutual funds to cryptocurrencies and ETFs, our platform simplifies investing and makes it accessible to everyone. Begin with a small amount, diversify, and watch your money grow.

Savings Plans

Reach your savings targets more quickly with automated strategies. Effortlessly set aside funds through round-ups, scheduled transfers, and high-interest savings options. Whether it’s for an emergency fund or a dream getaway, we aid you in saving more effectively.

Security Features

Your financial safety is our highest priority. Our app employs advanced encryption, multi-factor authentication, and fraud detection to safeguard your information. Feel secure knowing that your money and personal details are always protected.

Customer Support

Have a question? Our dedicated support team is always available to assist you. Whether you require help with transactions, security issues, or app functionalities, we offer prompt and friendly support 24/7.

User-Friendly Interface

Experience a seamless interaction with our intuitive and easy-to-use application. Designed for all users, our fintech app guarantees smooth transactions, quick access to features, and a hassle-free financial experience.

Personalized Insights

Receive customized financial insights based on your spending and saving behaviors. Our AI-driven analytics offer suggestions to enhance your financial health, helping you make better financial decisions every day.

Multi-Language Support

Feel confident banking in your chosen language. Our Fintech mobile application offers support for various languages, providing a smooth experience for users globally.

OUR APP DEVELOPMENT PROCESS

As a leading company in web and mobile app development, we utilize various well-known methodologies, including Waterfall and Agile, to create mobile application solutions that meet industry standards for all business requirements. Our top mobile application developers possess a wide range of experience, successfully building applications that range from startup-level to enterprise-level efficiently.

Feasibility Study & Project Discussion

Before commencing development, we perform a comprehensive feasibility study to assess the project’s scope, technical prerequisites, and market viability. Our team engages with you to gain insights into your business goals, target audience, and essential features. We also examine the need for regulatory compliance and identify potential obstacles to ensure the project is practical and conforms to industry standards. This stage establishes clear expectations and a roadmap for the app’s success.

Requirement Collection

During this phase, we collect all critical requirements to define the core functionalities of the app. Our specialists collaborate closely with you to outline financial workflows, security measures, third-party integrations (like payment gateways and banking APIs), and compliance with relevant industry regulations such as PCI-DSS or GDPR. We make certain that each feature aligns with your business objectives while emphasizing security, user experience, and scalability. This step lays the foundation for a robust and efficient fintech solution.

Designing of the App

An effectively designed fintech app is not only about looks; it also involves usability, security, and trustworthiness. Our UI/UX designers craft intuitive, user-friendly, and visually engaging interfaces that simplify intricate financial tasks. We prioritize smooth navigation, data visualization, and accessibility to provide a seamless user experience. Additionally, our design phase includes prototyping and wireframing to affirm the user journey before entering the development stage.

Development of the App

After the design receives approval, our developers commence building the app utilizing the most current technologies and secure coding methodologies. We adopt an agile development process, ensuring that the app remains adaptable and scalable as business requirements progress. Whether it’s mobile banking, digital wallets, investment platforms, or blockchain solutions, we incorporate advanced fintech features while maintaining top-tier security and adherence to financial regulations.

Testing of the Build

Given that fintech apps manage sensitive financial information, testing is an essential phase. We perform several rounds of thorough testing, including functional testing, performance assessment, penetration testing, and compliance evaluations. Our QA team ensures the app functions flawlessly under various circumstances, protecting it from vulnerabilities, cyber threats, and transactional inaccuracies. User acceptance testing (UAT) is also carried out to collect feedback and refine the application before its launch.

Launching of the Application

Once the app has undergone rigorous testing and refinement, we proceed with a structured deployment strategy. Our team guarantees smooth integration with financial institutions, regulatory agencies, and app marketplaces. We take care of backend setup, cloud deployment, and server configurations to ensure a seamless launch. Moreover, we support marketing strategies, user onboarding, and initial assistance to maximize adoption and engagement right from the start.

Post-Deployment Maintenance

The fintech landscape is continuously changing, along with user expectations. We offer ongoing post-launch assistance, which includes monitoring, bug fixes, security upgrades, and compliance maintenance. Our team ensures that the app stays current with evolving financial regulations and emerging technologies. As your business expands, we also help with scaling the app, incorporating new features, and optimizing performance for an improved user experience.

Feasibility Study & Project Discussion

Before commencing development, we perform a comprehensive feasibility study to assess the project’s scope, technical prerequisites, and market viability. Our team engages with you to gain insights into your business goals, target audience, and essential features. We also examine the need for regulatory compliance and identify potential obstacles to ensure the project is practical and conforms to industry standards. This stage establishes clear expectations and a roadmap for the app’s success.

Requirement Collection

During this phase, we collect all critical requirements to define the core functionalities of the app. Our specialists collaborate closely with you to outline financial workflows, security measures, third-party integrations (like payment gateways and banking APIs), and compliance with relevant industry regulations such as PCI-DSS or GDPR. We make certain that each feature aligns with your business objectives while emphasizing security, user experience, and scalability. This step lays the foundation for a robust and efficient fintech solution.

Designing of the App

An effectively designed fintech app is not only about looks; it also involves usability, security, and trustworthiness. Our UI/UX designers craft intuitive, user-friendly, and visually engaging interfaces that simplify intricate financial tasks. We prioritize smooth navigation, data visualization, and accessibility to provide a seamless user experience. Additionally, our design phase includes prototyping and wireframing to affirm the user journey before entering the development stage.

Development of the App

After the design receives approval, our developers commence building the app utilizing the most current technologies and secure coding methodologies. We adopt an agile development process, ensuring that the app remains adaptable and scalable as business requirements progress. Whether it’s mobile banking, digital wallets, investment platforms, or blockchain solutions, we incorporate advanced fintech features while maintaining top-tier security and adherence to financial regulations.

Testing of the Build

Given that fintech apps manage sensitive financial information, testing is an essential phase. We perform several rounds of thorough testing, including functional testing, performance assessment, penetration testing, and compliance evaluations. Our QA team ensures the app functions flawlessly under various circumstances, protecting it from vulnerabilities, cyber threats, and transactional inaccuracies. User acceptance testing (UAT) is also carried out to collect feedback and refine the application before its launch.

Launching of the Application

Once the app has undergone rigorous testing and refinement, we proceed with a structured deployment strategy. Our team guarantees smooth integration with financial institutions, regulatory agencies, and app marketplaces. We take care of backend setup, cloud deployment, and server configurations to ensure a seamless launch. Moreover, we support marketing strategies, user onboarding, and initial assistance to maximize adoption and engagement right from the start.

Post-Deployment Maintenance

The fintech landscape is continuously changing, along with user expectations. We offer ongoing post-launch assistance, which includes monitoring, bug fixes, security upgrades, and compliance maintenance. Our team ensures that the app stays current with evolving financial regulations and emerging technologies. As your business expands, we also help with scaling the app, incorporating new features, and optimizing performance for an improved user experience.

Benefits of Selecting Next Olive for Your Next Fintech App Development Project

Clear Project Milestones

At Next Olive, we prioritize transparency and clarity from the very beginning. Our organized project roadmap guarantees that each development phase is clearly outlined, keeping you updated and removing any uncertainty. With distinct milestones, you’ll always be aware of upcoming steps, minimizing risks and ensuring steady progress. This method allows us to stay aligned with your vision while achieving measurable outcomes.

On-Time

Delivery

In the fintech industry, time equates to money, particularly because market trends change rapidly. Our team employs agile methodologies and effective workflows to guarantee that your FinTech app is completed on time. Through proactive risk management and a commitment to deadlines, we effectively prevent delays, ensuring your project stays on course. You can rely on us for maintaining high quality in the process.

End-to-end communication

We keep you informed at every development phase through open and real-time collaboration. Whether through daily stand-ups, progress updates, or immediate support, we facilitate smooth teamwork. Our dedicated project managers and technical specialists are always available, ensuring that your concerns are promptly addressed. With us, you’re never left in the dark regarding your project’s progress.

Client-focused Approach

Your goals are our main priority, and we customize our solutions to fit your specific business requirements. At Next Olive, we invest time in comprehending your objectives, ensuring that the fintech app we create aligns seamlessly with your hopes. Our client-centric philosophy nurtures long-lasting partnerships, as we strive to provide solutions that genuinely add value to your business.

Select From Our Engagement Models for

Fintech App development services

Fixed Price Model

If you have a well-defined idea for a fintech app with specific requirements, our Fixed Price Model provides a clear, upfront cost with no unexpected expenses. This model is ideal for startups and companies that desire a predictable budget, ensuring your project stays on schedule and within financial limits. You will receive a high-quality app delivered within an agreed timeframe; no hidden charges, just outcomes.

Dedicated Team Model

If you require a team of skilled professionals that operates as an extension of your internal staff, our Dedicated Team Model grants you exclusive access to fintech specialists who concentrate exclusively on your project. This model is perfect for long-term development and changing requirements, offering flexibility, scalability, and smooth collaboration. You maintain control while we take care of the complex tasks.

Time and Material Model

For fintech projects that need flexibility and adaptability, our Time and Material Model is the right choice. You pay solely for the actual work completed, making it suitable for evolving needs, iterative development, or minimum viable products (MVPs). Whether you need ongoing improvements or unexpected modifications, this model allows you the freedom to innovate without strict limitations.

Tech Stacks We Used in Finance Apps

Full-Stack Development

Languages

Kotlin

Java

Swift

CSS

HTML

Python

Frameworks & Tools

Flutter

React Native

Xamarin

Ionic

XCode

Jetpack

Hosting & Storages

Cloud Hosting

AWS

Oracle Cloud

Google Cloud

Azure Cloud

Databases

MySQL

MangoDB

PostgreSQL

Design and Prototyping Tools

Sketch

Figma

AdobeXD

InVision

SalesForce

Axure RP

API & Integrations

GraphQL API

Google Pay

RESTful API

Mapbox API

PayPal

Stripe

Libraries

Android SDK

Django

NumPy

Glide

Pandas

Frequent Ask Questions

What is the Fintech App Development Cost?

The cost to develop a FinTech app depends upon the type, size, and complexity of the application.

- Basic Apps: $5,000 to $40,000

- Medium-Sized Apps: $40,000 to $100,000

- Large-Sized Apps: $100,000 to over $300,000

Where can I find Fintech mobile app developers near me?

Next Olive Technologies is the leading Fintech app development firm with over 12 years of experience in online food delivery app development. The company offers its food delivery app development services across 20+ countries such as the USA, Saudi Arabia, UK, UAE, Malaysia, Ireland, Israel, etc.

Do you provide web application development services?

As a prominent FinTech mobile app development company, our web app developers provide custom web app development services to our clients

What makes Next Olive Technologies a leading Fintech App Development Company?

Next Olive Technologies has 12+ years of experience in the finance sector. We have deployed 100+ applications and our customer-centric approach is what makes us different from other companies.

How many Fintech app development services do you offer?

We offer 6+ fintech app development solutions to our clients across 15+ countries.

Do you provide mobile wallet app development services?

Next Olive is a trusted Fintech app development services provider specializing in mobile wallet app development solutions for our clients.

Get a Free Proposal for Your

Dream

project

“Turn Your App Idea into Reality Now!”

Innovate and Elevate with Us!

Partner with Next Olive to Launch, Scale, and Succeed Globally. Let’s reach new heights together!

Partner with Us

Contact Info:

Office Address:

C-80, Tiwari Tower, Sector- N Aliganj, Lucknow, 226022, India

Business Address:

2400 Pkwy, Irvine, CA 92645, United States

Get Your Project Quote Today!

Thank you for considering Next-Olive Technologies! Fill out the form below, and we’ll be in touch within 24 hours to kickstart your project!

Looking For More Services?

Discover how we assist businesses in reimagining their business and accelerating their time-to-value by exploring our top-tier services!

Explore All Services

Sports Betting App Development