Cryptocurrency Exchange and Stock Trading App Development

The modern financial landscape witnesses the emergence of a new demand for innovative digital trading solutions. Secure, scalable, and customizable platforms help to serve diverse trading requirements by providing services in cryptocurrency exchange development through cryptocurrency exchange app development, white-label cryptocurrency exchange solutions, and quick market launch. More complex features can make possible the development of a stock trading app with complex tools enabled through services from a crypto trading bot development company. Customized crypto exchange development solutions and advanced development of crypto exchange platforms are mainly directed toward user-friendly experience and high security. Additionally, white-label crypto exchange software and the crypto MLM software allow the effective setup of competitive platforms in an ever-evolving trading ecosystem.

Table of Contents

ToggleIn this article, we will discuss different dimensions of developing a cryptocurrency exchange app and a stock trading app.

What is a stock trading application Development?

A stock trading application is one such platform from which a user can buy, sell, and track his stocks and other financial assets in real time from a digital platform. Such applications are made so that investing in the stock market becomes easy through the means of live market data, portfolio management, and smooth transactions. It would be a space for ventures that were looking into entering the financial technology space with the development of a stock trading application focused on developing better solutions for the enablement of investors with stronger tools and information for the same. Areas for development in the stock trading application would be user experience, security, and real-time data. Scalability and regulatory compliance define the requirements for developing investment apps in the stock market, focusing on the protection of users’ trust.

Features of stock trading app

[1] Live Stock Market Data

Timing is everything in stock trading. The stock price changes within seconds, so you will need information to make the decisions at the right time. That is why you should develop a stock trading application that provides live market data. The updates of prices, indices, and news will keep the user informed and ready to act instantly.

[2] Intuitive Simple Interface

When you make an app for trading, the first thing a user will note is the interface. This should be intuitive and friendly. No one wants to muddle their way through some complicated menu trying to purchase or sell stocks. This also makes checking out the newest stocks one finds at hand or evaluating performance feel just smooth and easy since it is conducted with the convenience of a very simple interface that lets people focus most on what actually matters that being investments.

[3] Real Live Stock Market Feed

Indeed the trick to using stocks while trading is about timing. The stock price may change in a second, so users require information to make quick decisions. Therefore, you should develop a stock trading application with live market data to update prices, indices, and news so the user will be kept informed and ready to act instantly.

[4] Advanced Trading Options

Advanced features in the trading platform would be required by professional traders, which include features such as limit orders, stop-loss orders, and even options trading. Such a feature would help the user implement some more complex trading strategies; thus, more control would be provided over the how, when, where, and on what terms to buy or sell. Creating your app for trading, it would indeed attract both beginners and professionals because of such options.

[5] Secure Transactions

Security is essential while doing any form of financial transaction. Any trading application needs to have safe payment integrations that are made using encryption and authentication. Thus, the information of a user and his funds will be protected and secure when one deposits the money into the account and while withdrawing the profits as well. These are some of the basic procedures in a successful stock market app development process.

[6] Portfolio Management

The app should give an overview of all stock holdings under one roof, which enables viewing, tracking, and analyzing every single holding. Be it long-term holding or constantly buying and selling, the overall management of a portfolio has always been necessary. That is what this feature can make users on top of their investments, thereby being more trackable for their performances and strategies to change at will when building a stock trading app.

[7] Customizable Alerts

Stock traders cannot wait for market news; they must know what is happening as it happens. A stock trading app that provides real-time alerts on price movement, market events, or stock-specific news can give users a competitive advantage. With push notifications and customizable alerts, users are always prepared, meaning even when not actively using the app, they make better decisions.

[8] Charting and Analyzing Tools

For the market analysis of traders, there should be interactive charting tools. Real-time graphs, performance indicators, and technical analysis tools make complex data meaningful to users. The provision of simple line charts or more advanced candlestick charts, enables the analysis of stock patterns and spotting of trends, thereby aiding the prediction of future market movement.

[9] Social Trading Integration

Making social trading features a specialty in your app will enhance the trading experience. Key features for live social feeds would include enabling users to track expert trades or to share tips and strategies amongst each other. Social trading allows users to learn from other’s failures and successes, thereby encouraging an ecosystem within your app as you create a trading app with social features to make users feel connected to a bigger universe of trading.

[10] AI-Powered Insights and Predictions

The most exciting feature of today’s stock trading apps is integration with AI-driven tools. When developing your trading app, AI can offer powerful features such as predictive analytics, automated trading strategies, and real-time insights based on market patterns. With this amount of data from history, AI algorithms are capable of making massive predictions about stock trends and are also helpful in making good decisions by users.

Demographics of a stock trading application

Applications for trading in stocks have exponentially increased in the last few years. The application is a very user-friendly platform wherein any user with or without experience can invest in the stock market. As the demand for digital trading solutions grows, knowledge of demographics becomes vital to the development of a successful stock trading application. What could help developers increase user engagement and satisfaction is targeting the right audience and designing a personalized experience. The article presents the major demographic trends shaping the landscape of the development of a stock market investment app and how businesses can use those insights to create a perfect stock trading app for diverse users.

[1] Age Group

The landscape of trading for stocks is no longer a territory for a professional investor. It includes a great demographic shift, and presently, millennials and even Gen Z can operate on the stock market platform through the mobile application. A new generation of customers is increasingly involved in digital services for digital platforms as well as digital financial services. The entry fee to the stock-trading application has become very easy to gain access to, with the easily accessible interface options and education related to investment in the stock market. If emphasized on intuitive design, gamification, and educational content would attract such young investors; a stock trading application would be created from which more of these users, given easy onboarding experience, personalized strategies for investment, and allowed to start with minimal capital, could be motivated and stimulated to invest.

[2] Gender Balance

The business of trading in stocks and investment was something predominantly engaged by men early on. That not withstanding, the trend is not the same now; that is to say, more women take part in the stock market than men. Different reports show that lately, more women have embraced the management of investments using trading apps for stocks. And as women break more barriers in finance, this emerging demographic has to be included in the development of the stock market investment app. A more inclusive platform would attract a wider crowd gender-neutral design with appropriate educational content. The alternative, in contrast, could be personalized financial advice or tools specifically addressing particular financial goals of women, likely to raise engagement and trust with the customer.

[3] Global Reach

The most astonishing trend in stock trading apps is the availability of global markets. It means that today, various geographically located people can create an app for trading in the stock market with content targeting a particular locality and in multiple languages while adhering to regional financial regulations. Stock market investment apps are the most attractive for users in emerging markets because they are making it possible for people to diversify their portfolios in ways that were not possible earlier. For developers, the key to reaching out to this demographic of the global population would be responsiveness to diverse regulatory environments, different currencies, and investment preferences across different regions. Support for international transactions, provision of local market data, and conformity to regional law could enhance the attractiveness of an app that offers stock trading.

[4] Income Level

No more have the affairs of stock trading apps remained a high disposable income people affair. The usability of applications has now opened the spectrum to the widest possible section of the population, right from entry-level traders to big-time investors. To prepare offerings in relation to the capacity of stock market investment app users, there is a deep understanding required of their differing financial capacities.

[5] Tech-Savvy Users

As mobile technology is shifting fast, the demand for time to enjoy seamless as well as intuitive app experiences has grown. Today, very fast, reliable,e and safe applications are sought after, not an exception to a stock trading application too. A noteworthy percentage demands real-time data processing on stocks, and quicker transaction processing with advanced analytics even while sitting in their comfort zone from their smartphones.

This new population of users will be targeted for an app for stock trading when investing in cutting-edge technologies in the form of real-time feeds of the market, recommendations based on AI, or secure login options such as biometrics. Improved fast loading time and easier navigation with access to essential features will ensure strong user retention and significantly reduce dissatisfaction.

[6] Learning Requirements

With increased trading through these stock trading apps, more resources for financial literacy are developed. Many investors will prefer tools that make sense as they try to understand the complexity of stocks. Therefore, any kind of stock market investment app development needs features like beginner-friendly tutorials, in-app analysis of stocks, and advice based on the market trend.

These educational features are specially made for first-time investors, youth, and others who previously avoided doing any kind of investment in the stock market as they were not aware of it. Due to the strong educational content presented, these stock trading applications have new users and make more confident and knowledgeable investors.

How does a stock trading application work?

Stage 1: User Authentication and Security

At the time of login, secure login protocols authenticate the users. All data that is exchanged between the app and the server are encrypted through SSL/TLS. No one can access them. Many also use two-factor authentication (2FA), where there is a second step for verification, such as an OTP or biometric scan. This way, only authorized users can access their portfolios and place trades.

Stage 2: Real-Time Data

The API integrations provided by the stock trading apps include pulling real-time stock prices and market trends from various financial data providers. Examples include stock exchanges or third-party services such as Bloomberg and Alpha Vantage. Commonly, WebSockets are used to keep the application and server in a persistent connection. When using WebSockets, live updates of data are pushed to the app without refreshing it, meaning traders can make immediate decisions based on up-to-date information.

Stage 3: Issuance

Once a user issues an order (buy or sell), the app requests order information – quantity, price, and order type and transmits this to the brokerage or exchange via an API. The order executes on the exchange and is subsequently matched by another opposing buy or sell. In the case where the order gets accepted, it contacts the server again for a confirmation of a trade. It would also make the app alert the user in real-time whether the order has been placed or not due to insufficient money or an invalid order.

Stage 4: Transaction and Settlement

After the trade is executed, the app communicates with the clearinghouse to ensure that the transaction is settled, or in other words, stocks and funds are transferred. Depending on the exchange, settlement can take a few days. The app updates the user’s portfolio with new stock holdings or cash balances after confirmation of the trade. This means the user will always have a correct representation of his or her assets and liabilities.

Stage 5: Backend Infrastructure

The backend takes care of key functionalities such as processing the data of users, execution of trade, and historical details storage. This is achieved via a microservices architecture where service (such as user management, trading, and retrieval of the data) functions independently yet in sequence. A relational or NoSQL database will be in place for the storage of user data, trade history, and portfolio details. The backend ensures data consistency across multiple platforms and controls the synchronization of the app, for example with stock exchanges.

Stage 6: Risk and Compliance Monitoring

For compliance, compliance checks are actually done where everything that goes out in terms of trade is regulated by the rules of a market, so be it margin or trading limits. Automated systems identify suspect and non-compliant transactions. The app further identifies uncommon trading behavior, such as rapid purchasing or selling of certain stocks, that could lead to fraud and market manipulation in order not to let users trade past the defined limits.

Stage 7: Push Notifications

The stock trading apps will use push notifications to alert the users of price changes, trade confirmations, price alerts, and any updates on the portfolio. The user will be reminded based on the preferences set like a major price movement in a stock, news affecting any stock, or when any order is executed. The notifications always keep the users updated in real-time without having to check their app every now and then.

Stage 8: Third-Party Integrations

The payment gateways, such as PayPal or Stripe, are utilized by the stock trading apps to make it a user-friendly experience through quick deposits and withdrawals. These integrations will ensure fast funding of an account or secure withdrawal of earnings. Most applications are integrated with tax and reporting tools. This makes users able to track capital gains, dividends, and their history for taxes.

Stage 9: Analytics

Advanced analytics tools process heavy volumes of trading data in the backend and provide users with insights into their performance, trends, and market patterns. Thus, machine learning can also facilitate giving a personalized investment strategy to a user based on the history of trade, his choices, and his risk-level tolerance. Users will hence utilize decision-making, strategies, and portfolios, maximizing the usage time.

Some examples of famous stock trading applications

[1] Robinhood

Robinhood has no trading commission, and the interface is really easy, so it suits beginners and experienced traders alike. It offers stocks, ETFs, options, and cryptocurrencies without any fees. For anyone looking to build a stock trading app, Robinhood is a fantastic example of a simple and user-friendly platform.

[2] Groww

Groww is a fast-growing app in India that lets users invest in stocks, mutual funds, and ETFs. With an easy-to-use interface and educational resources for new investors, Groww is an excellent model if you want to make a trading app that’s simple, accessible, and educational.

[3] TD Ameritrade

The app by TD Ameritrade is loaded with features a sophisticated trader would like to use, such as real-time information and the thinkorswim platform for thorough analysis. It is an example of the best way that trading applications are designed both for infrequent and frequent traders by having powerful functionality along with an easy-to-navigate application.

[4] Fidelity

Fidelity offers a comprehensive app with a wide range of trading options, retirement tools, and research features. It balances ease of use with advanced tools, making it an excellent choice for both beginners and experienced investors. For stock investment app development, Fidelity’s approach provides a great model.

[5] Binance

With very low fees, advanced features that allow one to trade, and great reach globally, Binance could serve as a good example in case one wants to implement a stock trading app that will include feature-rich functionalities of global and crypto.

[6] Merrill Edge

Merrill Edge integrates seamlessly with Bank of America accounts, offering stock, ETF, and options trading along with helpful research tools. It’s a good example of a stock trading app development that combines financial services with an easy-to-use trading platform.

What is a cryptocurrency exchange Development?

A cryptocurrency exchange would be a digital platform where people can trade cryptocurrencies like Bitcoin, Ethereum, and other altcoins. These apps support buying or selling digital assets with no hassle, hence providing a comfortable interface for both novices and professionals while trading. There are available cryptocurrency exchange apps whose features include price tracking, a secure wallet, trading choices, and portfolio management.

Companies seeking to venture into the crypto space would benefit greatly from exchanging service development companies through a customized application that would cater to their needs. Such companies develop software for cryptocurrency exchanges, which is rich in features such as real-time data feed, multi-currency, and high-level security protocols to safeguard funds and customer information.

Many entrepreneurs prefer white-label cryptocurrency exchange solutions that will enable them to deploy a branded exchange platform much faster. White-label solutions already have ready-made features which can be customized for a business’s unique branding and functionality.

P2P crypto exchange development is the new trend, as this platform allows users to directly trade with each other rather than relying on the old middlemen. The individuals willing to create a cryptocurrency exchange should look for experienced p2p crypto exchange development companies to ensure their exchange will meet the requirements of high security and user experience.

Types of Cryptocurrency Exchange Apps

Centralized and decentralized are two general categories that cryptocurrency exchanges usually fall into. There are unique features for both, and business objectives can decide the use of either of the above categories.

[1] Centralized Cryptocurrency Exchange Apps

Centralized exchanges are the kind of platforms where all transactions are managed by a central authority. They are very popular since they have fast transactions and are liquid. Though they work just like the traditional stock exchanges, it is only users who trust the platform handle their trades. Centralized crypto exchange development involves coming up with a platform where the users deposit their funds in the exchange. The latter then plays a role as if being a custodian.

A centralized exchange development company would be interested in making platforms with advanced features like crypto trading bot development for automating trading strategies, multi-currency support, and high-frequency trading capabilities. Businesses can also introduce customized cryptocurrency MLM systems, enabling rewards for users who refer others to the platform by building cryptocurrency exchanges with centralized systems.

[2] Decentralized Cryptocurrency Exchange Apps

Decentralized exchanges, or DEX, are exchanges where a user can trade directly from his wallet without having to depend on any third party. Such decentralized functionality is allowed through the development of P2P exchange, and applications developed on this model ensure users have increased privacy and control. P2P cryptocurrency exchange software helps to facilitate direct transactions between users, thus giving them the freedom to trade without trusting any central authority. Cryptocurrency exchange app development is secure with direct peer-to-peer trading using escrow services that protect every transaction.

Decentralized exchange platforms for businesses also cover white-label crypto wallets and exchange development so that traders experience smooth transactions from trade to wallet management.

[3] White Label Cryptocurrency Exchange Apps

White-label cryptocurrency exchange software development is an opportunity in which businesses can launch the branded exchange app without any hassle related to building it. A service allows businesses to avail their pre-developed solutions, carrying all necessary features such as crypto-to-crypto trading and fiat-to-crypto options, along with cryptocurrency MLM software integration.

In any white-label cryptocurrency exchange solution, high-end security, real-time data feeds, and compliance-enabled trading tools usually go into it. This is the kind of thing that can put businesses on the market quite fast, saving them some cost and time in having built a platform from scratch. It is a good chance for those who want to devote more efforts to marketing and customer acquisition rather than heavyweight software development.

Market Statistics of Cryptocurrency Exchange App

Cryptocurrency exchange app markets are growing at a very high speed because of the growth in digital asset adoption and advancement in blockchain technology. There is growing investment in cryptocurrencies by investors and institutions, hence raising demand for the development of a secure and scalable crypto exchange platform.

P2P exchange development is especially in vogue, promising greater privacy and lower fees. This has led to an increasing demand for p2p crypto exchange development services, with many seeking decentralized platforms to enable direct trades.

White-label crypto exchange development, where a business can get an exchange platform up and running quickly and with minimal cost. White-label crypto exchange software development has been the most convenient way to enter the market with less development time.

Security is at the top of the list, and cryptocurrency exchange software development companies are building platforms with advanced encryption and multi-signature wallets to ensure safe transactions. Some other popular features of this kind of app include cryptocurrency MLM software development. It helps encourage the growth of users on the exchanges with referral programs.

With the evolution in the market, this future of cryptocurrency exchange development service looks bright and optimistic with trends such as mobile-first platforms and AI-enhanced security as new normals. Whether one is interested in building cryptocurrency exchange platforms or designing a cryptocurrency exchange with white-label solutions, the opportunities are vast in this space that is rapidly growing.

Features of the Crypto Exchange App

[1] User-friendly, simple design

The interface should be user-friendly. An excellent crypto-exchange application ought to be intuitive to make it easy for the user to trade and monitor his or her portfolio with minimal taps on the app.

The arrangement should be clear and even straightforward for a beginner in case you do not find yourself overwhelmed by focusing much on trading.

[2] Variety of Cryptocurrencies

Good exchange apps provide access to lots of different cryptocurrencies. While a coin such as Bitcoin or Ethereum is usually popular, the best applications free up your time to consider and work with altcoins to expand your portfolio and keep track of current market trends.

[3] Real-Time Market Data

The prices of cryptocurrencies keep fluctuating and, therefore it is imperative to stay in tune with such changes. Top-notch exchange apps give real-time price updates and charts with trends. Using these you can make the best choices possible. You can set alerts so that you are updated at all times about market moves so you never miss the best chance of making a profit.

[4] Advanced trading features

Strong features in the trading system include margin trading, stop-loss orders, limit orders, and many more for expert traders, to give them control over risks, and enable them to make more strategic moves. Advanced charting tools as well as technical indicators like moving averages will help analyze the market and then plan their trades.

[5] Strong Security

Security above all things. Look for apps with 2FA, biometric login, and cold storage that will make sure your money doesn’t get hacked. These features help guarantee security at all times both to the account and your cryptocurrencies.

[6] Wallet Integration

Many crypto applications allow you to send and receive coins with an integrated wallet. With that, you don’t need a third-party service to manage your cryptos. Some applications even let you attach hardware wallets for protection purposes.

[7] Instant transactions

The best exchange apps allow instant buying and selling. Crypto markets are very volatile, and to maximize chances, you should execute trades in real-time. This is why the quick execution of transactions makes it possible for you to buy or sell without delay.

[8] Responsive Customer Support

Great customer care can easily solve any problems very fast. A good crypto should always have live chat, email, or phone support so one is guaranteed help at every minute with any technical glitch or an account-related concern.

[9] Legal compliance

The system complies with local and international regulations like KYC (Know Your Customer) and AML (Anti-Money Laundering), so that the system is secure and trustworthy. It not only safeguards the users but also sustains a safe trading environment.

[10] Multi-Device Access

Seamless working from any kind of device; whether a mobile, tab, or computer, sync your account, and know about the trade anytime, is an application of the good crypto exchange

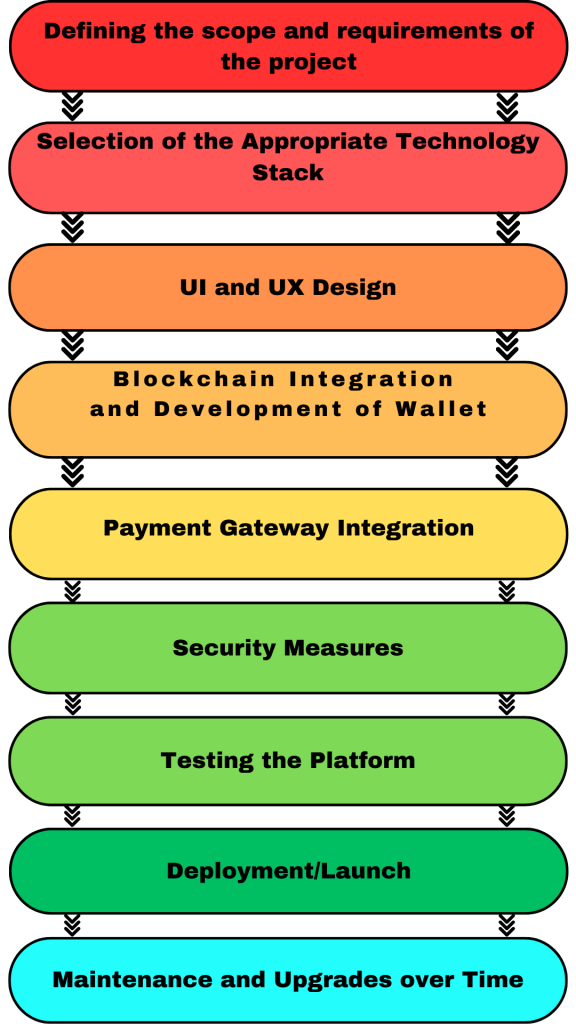

The step-by-step development process of stock trading and crypto exchange applications

[1] Defining the scope and requirements of the project

This is the first step of development and means defining what features your app will support. That would be wallet integration, options for trading, and even a payment gateway. It becomes important to decide whether it’s a centralized cryptocurrency exchange or a decentralized crypto exchange that you want to develop. This will greatly affect technical infrastructure and the features to be included. Cryptocurrency platforms’ nature demands a method for either acquiring a white-label crypto exchange software development that has an in-built solution with customization options or a more tailored approach. Of course, knowing what your users need is very important; whether it’s going to be a P2P crypto exchange peer-to-peer trading setup or hybrid crypto exchange development trying to connect the features of both centralization and decentralization.

[2] Selection of the Appropriate Technology Stack

Choosing the correct technology stack is a very crucial decision. It affects the performance, scalability, and security of the application. For crypto exchange applications, developers usually use programming languages like React Native for trading apps or apps made with Firebase for easy integration in the backend.

You will also determine whether to go with a blockchain development framework such as Ethereum or Binance Smart Chain or develop your cryptocurrency development protocol. A cryptocurrency exchange software development company can be consulted on the appropriate stack that should be selected according to specific needs such as safety, speed, and scalability.

[3] UI and UX Design

The trading platform core is about user experience. The design should be intuitive and user-friendly so that users can trade without any hassle and portfolio management will not create confusion among them. Some of the primary design factors include the following:

- Simple process for registration

- Transparent option to log in

- Safe options that may normally include MFA

Whether you are designing a p2p cryptocurrency exchange or building a fully-fledged trading platform, your design has to accommodate many different devices, from desktops to mobile phones. An approach for a React native trading app works best in providing seamless experiences on both iOS and Android.

[4] Blockchain Integration and Development of Wallet

This is where magic comes into play for any crypto exchange. You’re going to need a very secure blockchain to handle transaction security. When you are planning to offer your users the possibility of trading different cryptocurrencies, supporting multiple blockchain networks, such as Bitcoin, Ethereum, Litecoin, and so on, is quite important.

To implement secure transactions, you should develop a wallet system for multiple cryptocurrencies. Whether decentralized crypto or centralized, wallet integration forms the backbone of it all. Moreover, cryptocurrency MLM software can be integrated to let people earn through referral programs as well.

[5] Payment Gateway Integration

The payment gateway should function as seamlessly as possible to do fiat-to-crypto and vice versa. If your application allows users to deposit or withdraw their funds in traditional currency, you need to integrate the payment processor that supports not just crypto transactions but also, for example, bank transfers, credit cards, and PayPal to provide the same known and hassle-free experience for them.

Payment gateways should also be compliant with financial regulations that may vary depending on your target market. It would therefore be prudent to seek help from a cryptocurrency exchange development company that is aware of the intricacies of crypto-finance and can build safe, compliant systems for your platform.

[6] Security Measures

Security is a top priority while building trading and exchange applications.In the case of the gigantic numbers of transactions that are made through these applications, one needs to protect it from cyber threats. The safeguards undertaken include:

- Two-factor authentication (2FA)

- Employing SSL encryption

- Implementation of cold storage wallets

- Security audits and penetration testing

Ensuring your platform is secure is important to gain the trust of users and maintain a good reputation as an exchange. A cryptocurrency exchange software development company can include industry-standard security protocols in your platform.

[7] Testing the Platform

Launch your app, testing it fully so it’s stable and secure, which will include:

- Functionality Testing: Making sure that the deposit/withdrawal, trading, and portfolio management functions work well.

- Security Testing: Ensuring that data is encrypted and has no vulnerabilities.

- Performance Testing: Making sure the app works great under heavy traffic loads, especially at peak trading hours.

- User Acceptance Testing (UAT): Getting feedback from actual users to refine the user interface and experience.

Depends on the complexity of features being developed and the testing that needs to be done when it comes to the trading app cost.

[8] Deployment/Launch

Once it’s tested successfully, it is ready for deployment. Cloud servers allow the deployment of your crypto exchange platform and scalability, as the more users it grows to be able to handle while opting for a centralized or decentralized exchange, ensuring that it’s deployed to give maximum uptime and fast transaction processing.

Launch the app on as many platforms, be it Google Play or Apple App Store, so your React Native trading app hits all four corners of the earth.

[9] Maintenance and Upgrades over Time

After launching any platform, support has to be rendered continually. Periodical updates are required to eliminate bugs, introduce new features and regulations, etc. A robustly designed maintenance plan ensures that your platform performs efficiently and safely.

You may need to implement new features in cryptocurrency exchange apps as the market develops, or even support emerging technologies such as Coinbase blockchain development. Continued improvement and awareness of crypto exchange development trends will mean that your platform remains competitive in an increasingly growing market.

AI integration in stock trading and cryptocurrency exchange apps

[1] Smarter Decision-Making with AI

AI-powered stock trading and crypto apps take decision-making to a whole new level with machine learning: delve deeper into historical data to unveil hidden patterns and predict the future trends of the markets. Consider, for example, an MLM cryptocurrency software development company. That firm can use AI to ensure not only easier distribution of rewards but also to make sure each transaction on the network is transparent and trustworthy.

Similarly, cryptocurrency exchange development services by a centralized cryptocurrency exchange development company use AI to enhance risk management. In these exchanges, AI algorithms would scrutinize user behavior as well as market changes to detect anomalies and offer the best-optimized trading strategies for a user.

[2] Real-time data analysis

With real-time insights, which is something that the fast-moving market of cryptocurrencies aspires towards, the integration of AI will provide the ability to quickly match the buyers with sellers, ensure liquidity,y and hence seamless transactions by an ai-enabled p2p crypto exchange development company. The use of tools like Coinbase blockchain developer tools would also ensure that developers utilize predictive analytics to help the traders make a decision faster.

[3] Security and Fraud Detection

The primary targets of hackers and fraudsters are cryptocurrency exchanges. Therefore it is the first issue in the space. And it’s where AI kicks into action. Imagine a decentralized crypto exchange development company where AI helps monitor blockchain transactions for irregularities and unusual patterns that will protect users’ funds. By taking such an approach to security, these platforms both protect their users and begin building a strong reputation as a trustworthy and reliable exchange that can be relied upon.

[4] User Personalization and Experience

Trading and cryptocurrency exchange apps focus much more on user experience than previous versions. AI is useful in personalizing the interface and features according to an individual’s preferences and behavior. When businesses are creating their own cryptocurrency exchange and trading app, usually AI-driven chatbots, personalized alerts, and intuitive dashboards help retain and satisfy users.

Other than that, the apps that are developed through Firebase use AI-integrated applications through analytics and marketing services. This makes a company more efficient in catering to its clients.

[5]Emerging Trends: Decentralized Applications

For openness and control, decentralized applications come into the limelight. With a decentralized cryptocurrency development company that has the integrations of AI, smarter token management through predictive market analytics with automatic trading bots make for an empowered ecosystem for users.

[6]Challenges and Opportunities

The integration of AI with the crypto app comes with all kinds of challenges, from development costs to ethical and updation issues. However, getting the right cryptocurrency exchange development company with which to partner assures companies overcome these hurdles the right way. From creating secure frameworks to deploying scalable solutions, all kinds of end-to-end support can be expected.

Differences between the stock exchange and cryptocurrency exchange apps

[1] Nature of Securities Sold

Stock Exchange Applications: Involved with traditional securities stocks, bonds, and ETFs. All these are ownership or debt paper.

Cryptocurrency Application: Only deals with the asset which is Bitcoin, Ethereum as well as altcoins. One needs blockchain technology. Primarily, it should work as a medium of exchange or investment.

[2] Rules

Stock Exchange Apps: They are very regulated by financial law enforcement bodies, for example, the SEC in the US or SEBI in India. This is a saver of time, saves investment, and everything becomes transparent and according to the laws of the financial market.

Cryptocurrency Exchange Apps: Less regulated; laws are not the same from country to country. It is either they allow their exchange with a framework and in some, it is either prohibited or banned.

[3] Trading Hours

Stock Exchange Applications: Trades in these apps are only possible within market hours. For example, New York Stock Exchange, NYSE is open Monday through Friday, from 9:30 AM to 4:00 PM EST, hence timing can be a decisive factor for these traders.

Cryptocurrency exchange apps: This is different from the traditional stock exchange, as crypto trading never sleeps. The exchange runs 24/7, and users can thus trade at any hour be it morning coffee time or midnight brainstorming. Around-the-clock availability is of great appeal to users who hail from all corners of the world.

[4] Volatility and Risk

Stock Market Applications: However, the prices of these stocks are relatively stable notwithstanding the volatility of the market as it is based on real things like how the companies are doing, economic factors, and international events. This is not the same with crypto, which is rather unstable.

Cryptocurrency Exchange Apps: Prices of cryptocurrencies are subject to very high volatility in terms of speculation, changes in technology, and regulatory issues.

[5] Ownership and Custody

Stock Market Apps: Stocks are largely held in dematerialized form through brokers or financial institutions. The ownership is registered and supported by the law.

Cryptocurrency Exchange Apps: Cryptocurrencies are held in exchange wallets or personal wallets (hot or cold). Users have to keep their private keys; otherwise, they will lose them permanently.

[6] User Interface and Accessibility

Stock Exchange Apps: Generally more conservative in design, they are chart-and-report-based. These are designed for professional investors and institutional clients, offering advanced tools and resources for experienced traders.

Apps for trading digital currencies: The younger, more technology-savvy generation uses these apps because they are designed entirely. It typically includes interactive elements like trading incentives to enhance engagement and accessibility

[7] Fees and Costs

Stock Exchange Apps: Fees usually depend on the brokerage service and could be fixed amounts or percentages of the trade. Other costs could include maintenance fees or advisory charges.

Cryptocurrency Exchange Apps: The cost can be different, but commissions that are applied for the transaction, withdrawal charges, and blockchain charges which are the case in gas fees such as that on Ethereum are common. Most of the charges tend to be dynamic based on activities in the network.

[8] Decentralization

Stock Exchange Apps: These work based on a centralized model. Here, intermediaries through brokers and institutions facilitate trades. The work of brokers, financial institutions, and regulatory bodies also plays quite an important role in these apps.

Cryptocurrency exchange apps: There are centralized exchanges but the cryptosystem also contains decentralized exchanges called DEXs whereby a peer-to-peer exchange between individuals without middlemen is observed.

[9] Purpose of Investment

Stock Exchange Apps: This often attracts long-term investors, who make a portfolio through dividend payoffs and also grow wealth in a sustained manner.

Cryptocurrency exchange apps: Both the short-term gain speculators and the long-term blockchain believers, want short-term gains or acceptance of a new paradigm for the financial world.

Cost to develop stock trading and crypto exchange apps

In today’s digital world, apps related to stock trading and crypto exchange have picked up rapidly. Be it as an entrepreneur looking to foray into the finance sector or be it a company that wants to increase its portfolio of services, understanding how much it will cost one to develop such platforms will become essential. Let us go through some of the key factors that make the development cost of stock trading and cryptocurrency trading platforms important along with the key consideration of planning your app.

Factors of Influence on the Cost

There is always an aspect of cost variation involved with the development of stock trading and crypto exchange apps. Different factors determine the overall price of the development process, including the complexity of the platform, the range of features, and the degree of security required.

[1] Features and functionalities of an app

The more complex the app, the more expensive will its development be. Simple trading apps for stocks only display the minimum functionalities like live market data, buy and sell options, and portfolio tracking. But a full-fledged crypto trading platform would likely come with wallet integration, real-time updates on the price of the crypto, payment gateway for many, and secure processing of transactions.

[2] Platform Type

Developing a trading app for the stock and cryptocurrency markets can be done for both web and mobile platforms, namely iOS and Android. The platform type will influence the development process. A native approach to developing an app is usually pricier than a cross-platform solution because different operating systems require separate codebases to be built. However, there is a cost-effective reason for native apps, in particular, since the performance improved and user experience is all so much more worth it in that case.

[3] Security Features

Safety is also what financial apps are concerned about. You do pay for the strong encryption, 2FA, anti-fraud mechanisms, and secure payment integrations.

It is certainly not something to compromise on and will increase the crypto exchange development cost by a hefty margin. You don’t want to be remembered for the security breach. The safety of users’ funds and data is essential to success.

[4] User Interface (UI) and User Experience (UX) Design

The difference will be made in a smooth, intuitive, and easy-to-navigate interface. For a cryptocurrency trading platform, it should enable users to quickly take action, grasp market trends easily, and make trades with no hassle. Good UI/UX design enhances the user experience but also raises the costs of development.

[5] Legal Compliance and Regulations

There is a need for every stock trading and crypto exchange app to follow specific financial regulations. Building a cryptocurrency exchange may require KYC, AML checks, and reporting to competent authorities. Legal compliance takes more time and skill for development and will ultimately increase overall costs.

[6] Cost Estimates

Before you start building a cryptocurrency trading platform or stock trading application, be sure to factor in costs that range from $30,000 to well over $500,000, depending on the extent of features and the level of security required. Here’s a little more detail on the costs:

Basic Trading App: The cost can be on the lower side for a simple stock trading application with basic functionality, like $30,000-$50,000, which may include features such as account creation, real-time market data, order execution, and basic analytics.

Intermediate Crypto Exchange Development: An advanced crypto exchange platform, multi-support for cryptocurrencies, and wallet integrations with enhanced security features can be developed at a cost of between $100,000 and $250,000. The price is in addition to the user dashboard, real-time updates to prices, and admin panels.

Advanced, high-security platforms: An enterprise-level, all-fledged cryptocurrency trading platform or stock exchange application will start at a level of $10,000 and may go up as high as $500,000 or even more. They include support for multi-currency, advanced trading tools and analytics driven by artificial intelligence, and tight security among them.

Examples of Cryptocurrency Exchanges Applications

(1) Binance

Binance is the very first exchange in the world to have a mobile application that supports over 100 different cryptocurrencies. It has advanced charting tools, allows for real-time data, and has fairly low trading fees for both beginning and professional traders. Its smooth integration with stock trading app development also enables users to learn about various financial instruments.

[2] Coinbase

Coinbase is very simple and easy to use. It has users who can trade significant cryptocurrencies such as Bitcoin and Ethereum with a secure wallet. This is a great app for beginner cryptocurrency users.

[3] Kraken

Kraken is an advanced trader app that allows for margin and futures trading. It is well known for its tremendous security features to afford users control of their investments.

[4] Gemini

Gemini thinks highly of security and operates on compliance. It has more than 30 cryptocurrencies that support staking and 2FA, thus making it what can be best considered a platform for security-conscious people’s use.

[5] eToro

It’s a platform that supports more stock trading, but eToro has an extremely strong cryptocurrency exchange feature. All trades for all stocks, crypto, and commodities may be traded from one software.

Insights from Next Olive Technologies: Revolutionizing Crypto Exchange App Development

Cryptocurrencies not only transformed the global financial industry but also created a demand for safe-and-user-friendly crypto exchange apps. Next Olive Technologies, a leading developer in the USA, Our mobile apps using artificial intelligence technologies, is taking the lead in this space. With 12-plus years of experience and experience delivering cutting-edge solutions to 20-plus countries, the enterprise has already gained quite a reputation as a trusted partner for businesses longing to benefit from blockchain technology.

Next Olive Technologies develops crypto exchange apps that are highly secure, scalable, and feature-rich with their offerings tailor-made to meet the demands of an ever-changing crypto market. User experience, trading capabilities, and securing their solution are the features that allow their client businesses to stand out in the competitive field of crypto.

By joining technical acumen with the ability to read future trends, Next Olive Technologies works with its clients to open new avenues in the digital currency ecosystem. From startup endeavors into crypto to larger players working to innovate, the company’s uncompromising commitment to excellence and innovation makes it a key contributor to the revolution in crypto exchange app development.

Conclusion

Creating apps for crypto exchange and stock trading is now crucial for companies looking to take advantage of the increasing demand for digital trading solutions in the fast-changing financial landscape. The need for a reliable, secure, and user-friendly application becomes crucial in keeping up with the competition as interest in cryptocurrencies and stock markets from both retail and institutional investors continues to grow. A cryptocurrency exchange app development will require some very strong security features, smooth transaction abilities, and current data refreshes to provide an efficient user experience. Similarly, for a stock trading app development, the main focus has to be on up-to-date market information, ease in order entry, and good risk management features. Businesses leveraging those technologies would be well poised to bring innovative answers which would further empower user-end decisions that are far from being misled in trades that range between cryptocurrency-based applications and real stock trade, therefore quality investment of its application would unlock an unseen future that would only show promise towards growth within digital-first perspectives.

Frequently asked questions (FAQs)

It is the development of a virtual digital currency trading platform that allows its users to trade with one another in a safe manner. Some of the basic features it will include are real-time price tracking, wallet integration, order book, and secured transactions.

The two main options are developing your own cryptocurrency exchange and trading app, or locating a company that specializes in cryptocurrency exchange development. The latter will involve developing secure user-friendly interfaces compliant with all regulations.

These are a few of the top crypto exchange development companies like Binance, Coinbase, and Gemini, which focus on establishing secure and strong platforms and ensuring services such as cryptocurrency exchange app development, decentralized crypto exchange development, and white-label crypto wallet and exchange development.

Small app: $5,000 to $10,000

Medium app: $10,000 to $200,000

Large app: Above $200,000

P2P cryptocurrency exchange development is the creation of a platform where users can trade directly with each other, having no central authority, which enhances privacy and security.

Trading app development cost depends much on many factors such as the complexity of the platform, features like the cryptocurrency trading platform or decentralized crypto exchange development, design elements, security, and expertise of the development team.

Yes, you can develop your own cryptocurrency exchange and trading app by collaborating with a cryptocurrency exchange development company. This would be in the form of developing a secure platform for trading cryptocurrencies and probably integrating a white-label crypto exchange software development solution.

Decentralized crypto exchange development refers to developing a peer-to-peer exchange platform for cryptocurrencies that allows trading directly between users without a centralized authority in charge of the exchange.

Apps built with Firebase can also be a good fit for cryptocurrency exchange app development, particularly in cases of real-time syncing of data, authentication, and other back-end services, but additional customizations may need to be added for security and compliance purposes.

With the aid of white-label crypto exchange and wallet development, business concerns can establish their cryptocurrency exchange by using already pre-developed and customizable software solutions. The result of such approach will be saving time to the market but providing a cost-efficient means to creating the crypto trading platform.

Cryptocurrency MLM is a multi-level marketing software development in which a platform is built integrating cryptocurrency for MLM business users to invest, trade, and earn rewards in the form of digital currencies. Technoloader is an example of a cryptocurrency MLM software development company.