Stock Trading App Development: Cost, Tips, and Features

Table of Contents

ToggleThe finance industry is changing quickly, especially with the rise of stock trading apps. These apps are essential for today’s investors who want easy access to global markets. Looking ahead to 2025 and beyond, we expect more demand for secure trading platforms that meet the growing needs of individual investors and advancements in financial technology. Creating stock trading applications requires a mix of skills, smart technology, and a focus on user-friendly design. This blog will explore the key elements involved in stock trading app development, such as integrating real-time market data, adding charting tools, following regulations, and implementing strong security features.

What is a Stock Trading App?

A stock trading app is a simple app to invest in the stock market from your phone or tablet. These apps let you buy and sell stocks, track your portfolio, and follow market trends from anywhere. They offer tools like live data, charts, and news feeds to help you make informed decisions. Whether you are a beginner or an experienced trader, these apps make investing easier. Previously, investing in the stock market might have seemed complicated or risky. Today, these apps are more secure and user-friendly than ever.

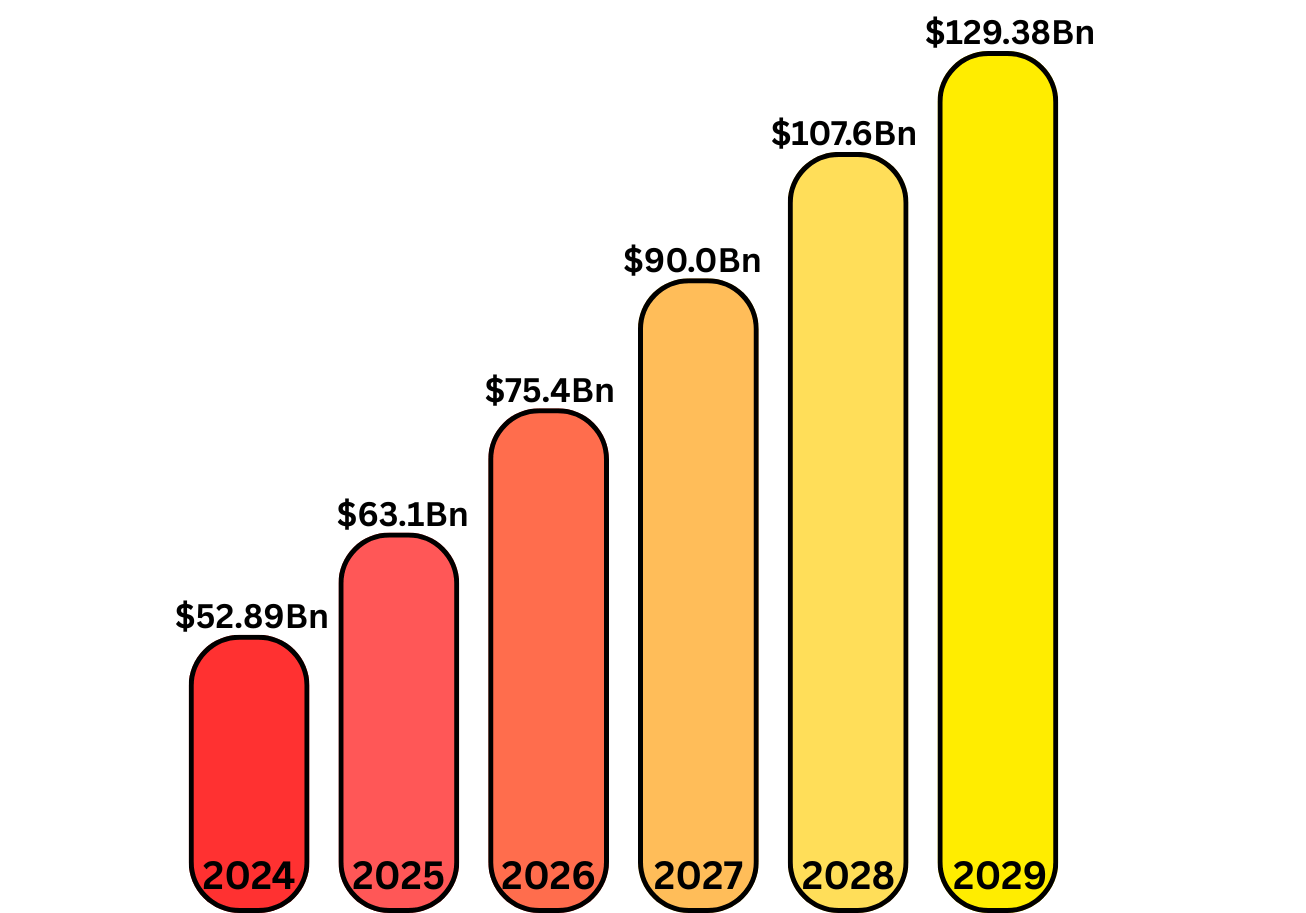

Global Market Statistics of Stock Trading Apps

According to The Business Research Company, the market for stock trading and investment apps is growing rapidly. It increased from $52.89 billion in 2024 to $63.1 billion in 2025, with an annual growth rate of about 20.1%. This market is expected to increase by 2029, reaching $129.38 billion. Several trends are contributing to the growth: more people are choosing to invest on their own, digital platforms are becoming more popular, smartphones are widely used, and strong security measures are increasing trust in online trading.

Why Invest in Stock Trading App Development?

A stock trading app is a smart choice in today’s fast-paced financial world. More people are investing on their own, so the demand for easy-to-use, secure trading platforms has grown significantly. A well-designed app allows users to buy stocks, track their portfolios, and analyze market trends from anywhere, making it easier for more people to get involved. These apps not only meet user needs but can also make money through commissions, extra features, and tutorials for new investors. A user-friendly trading platform can attract a large audience and help people learn more about finance. The rise in fintech has created room for innovation, including AI-driven insights, social trading, and various integrations, making this a good investment for long-term growth.

Top features of a Stock Trading App

[1] AI-Based Stop Loss

AI-based stop loss uses machine learning to monitor the market in real-time. The system looks at price trends, market volatility, and historical data to identify potential risks. If a trade starts to go against your goals, the AI automatically adjusts the stop-loss level based on its market analysis. This means the stop loss is not fixed; it changes with market conditions to help minimize losses, even if the market moves unexpectedly.

[2] Portfolio Management

An AI-based portfolio management system finds the best investment strategy based on your financial goals and risk tolerance. It uses market data to help make these decisions. The AI constantly analyzes your portfolio’s performance and makes adjustments, like rebalancing assets or changing investments to match current market conditions. This approach can help maximize returns while reducing risks through real-time analysis, ensuring your investments support your long-term goals.

[3] Margin Trading

Margin trading allows you to borrow money from a broker to invest more than you have. This means you can use extra funds to trade. An AI system monitors your trades and adjusts your borrowing based on the risks involved. If the market moves against you, the AI can send alerts or make changes automatically to help you avoid losing more money than you can afford. When used carefully, this makes margin trading easier and less risky.

[4] Risk Management

AI-based risk management helps by looking at market trends and past data to spot potential risks in real-time. The system adjusts your risk exposure based on changing market conditions. This provides flexible solutions, like diversifying assets or changing stop-loss levels. By constantly evaluating all risk factors, AI helps you stay proactive and reduce losses, even in uncertain and volatile markets.

[5] AI-based Short Selling

AI-based short selling uses algorithms to predict which stocks or assets are likely to drop in price. The system scans the market for signals, such as price changes, news, or economic data that suggest a decline. It can then alert you to potential short-selling opportunities. The AI also helps you execute these strategies at the right time, allowing you to take advantage of falling prices in a smart way.

[6] Real-Time Market Data

AI-driven real-time market data analyzes stock prices, news, and economic indicators instantly. It processes vast amounts of information in milliseconds, giving you timely insights and alerts about market movements. With quick access to data, AI helps you make fast decisions, take advantage of new trends, and avoid delays and outdated information.

[7] Push Notifications

With push notifications, you receive timely updates about your trades, portfolio, and market changes directly on your device. The AI system will decide which alerts you get based on your preferences and market activity. It will filter and prioritize important information, such as when a stock hits a target price or major market news. This helps you react quickly instead of constantly watching the markets.

[8] Data Security

AI-powered data security uses advanced encryption and machine learning to protect sensitive trading information. These systems look for unusual patterns or possible threats in real time, ensuring that any suspicious activity is flagged. AI keeps up with changing cyber-attacks, helping to keep your personal and financial information safe from hackers. This proactive approach gives you peace of mind when trading online.

[9] Data Analysis

AI-based data analysis gathers large amounts of financial information to find trends and patterns that people might not notice at first. It looks at everything from how stocks perform to how the market feels. This helps you make better trading decisions. AI presents the information in simple formats, allowing you to quickly and accurately act on opportunities, which improves your chances of making good trades.

[10] Watchlists

AI-powered watchlists help you track and monitor stocks, commodities, or other assets that interest you. The AI constantly checks price movements and news related to the items on your watchlist. It keeps you updated about important changes, filtering out unnecessary information. This way, you can focus on what matters most to your strategy and be ready to act at the right moment.

[11] Market Research Tools

AI tools for market research gather and analyze information, news, and financial reports about market trends. They help you find potential investment opportunities by considering current trends, company performance, and macroeconomic factors. These tools reduce the time you need to spend on research, allowing you to make better trading decisions.

[12] Take-Profit Orders

AI-driven take-profit orders execute a trade when an asset hits your target price, locking in profits. The AI system uses market conditions and price movements to ensure your order is made at the right time. This approach helps you stick to your strategy without emotional or impulsive decisions, allowing you to capture profits automatically without constant monitoring.

[13] AI-powered Leverage

AI-powered leverage finds the best level of leverage to use based on real-time market data and your risk profile. The system looks at market volatility, asset correlations, and your current portfolio to suggest the right amount of leverage. AI automatically adjusts the leverage as market conditions change, maximizing your returns while controlling risks.

Advantages of Stock Trading Applications

Before diving into trading app development, it is important to know about its various advantages.

[1] Real-Time Market Access

Stock trading apps give real-time updates on stock prices, market trends, and important news. This helps users not miss any investment opportunities. You can check your investments anytime and from anywhere using your smartphone. This quick access to information allows you to respond quickly to market changes. Whether you’re commuting or doing your work, you can always stay connected to the market.

[2] User-Friendly Interfaces

Most trading apps are easy to use for both beginners and experts. They have clear dashboards, simple navigation, and helpful prompts that teach users and reduce stress while trading. Complex financial topics are simplified into easy-to-follow steps for making trades. The apps also offer demo accounts, so users can practice before using real money.

[3] Cost-Efficient

Trading apps lower the cost of investing compared to traditional brokers. Many platforms offer commission-free trades on popular stocks and ETFs, allowing you to keep more of your earnings. They also remove the need to work with in-person brokers, saving you time and money. This affordability makes it easier for more people to invest in financial markets.

[4] Empowered Decision-Making

These applications help users make informed decisions by offering tools like real-time charts, stock screeners, and AI-driven insights. You can look at past trends, evaluate key performance indicators, and confidently create your investment strategy. Risk analysis and portfolio tracking keep you ahead of the game. These resources enable every investor to participate knowledgeably in the market.

[5] Customization and Alerts

Stock trading apps let you personalize your experience with custom notifications. You can receive alerts for price changes, news, or events like earnings reports. This keeps you updated without needing to check the app all the time. You can also create custom watchlists to focus on the stocks and markets that are most important to you.

[6] Accessibility to Diverse Markets

Trading apps provide easy access to both local and international markets. This makes it simple to diversify your portfolio. Whether you want to buy US tech stocks or explore Asian markets, the app helps you do this. Most platforms also let you trade cryptocurrencies, commodities, and indices, giving you a wide range of asset options. This helps reduce investment risks and increase opportunities.

[7] Enhanced Security Features

Modern trading apps prioritize the safety of your data and funds by using strong security measures. These include 2-factor authentication, biometric logins, and end-to-end encryption. The apps regularly update and follow financial regulations, allowing you to trade safely.

[8] Opportunities for Learning and Growth

Many trading apps also provide educational resources, such as tutorials, webinars, and articles, to improve financial knowledge. Beginners can use demo accounts to practice trading without real money, while experienced traders can use advanced tools to refine their strategies. This helps users learn and grow continuously.

[9] Seamless Integration with Financial Tools

Trading apps often connect with budgeting tools and financial planners. This gives you a complete overview of your finances, helping you align your investment goals with your overall financial strategy. Features like expense tracking and saving analysis make it easy to incorporate trading into your financial goals.

[10] Social Features

Some apps include social trading, allowing you to follow successful traders and follow their strategies. These features make trading more collaborative and create a shared learning experience. Engaging with a community of investors helps you keep motivated and informed about new opportunities.

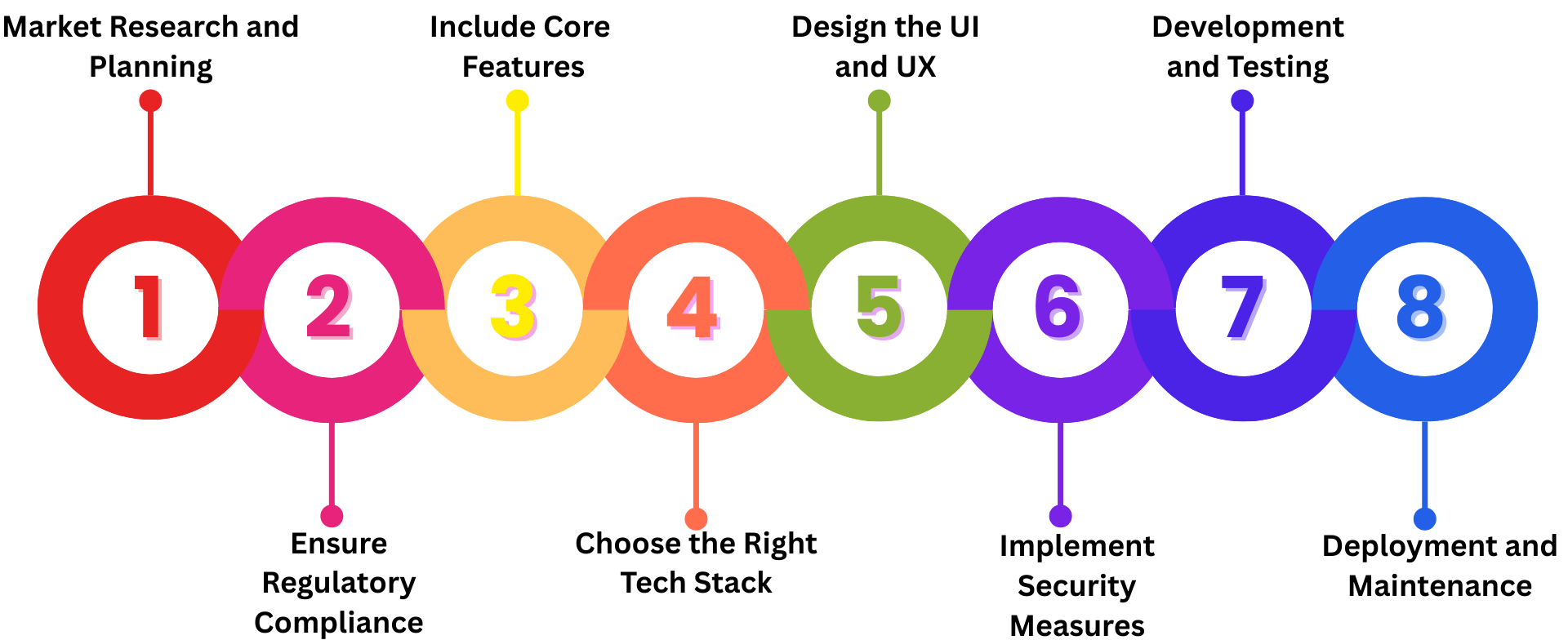

Follow a Comprehensive Stock Trading Application Development Process

Step 1: Market Research and Planning

In the first stage, focus on understanding the market. Identify your target audience, their trading habits, and pain points related to existing applications. Analyze competitors, look at their features, user reviews, and market positioning to see what works and where there are gaps. Next, define a unique value proposition. This could be a lower fee, better analytics, or a simpler user experience. This proposition will guide your marketing and development efforts. Finally, decide on the type of app you want to create: will it be for day trading, long-term investments, or both? Consider creating a hybrid app to attract different types of users and broaden your audience.

Step 2: Ensure Regulatory Compliance

Stock standing apps must follow strict regulations. To ensure compliance, keep the following in mind:

- SEC Regulations (for US apps): Your platform should provide clear information and follow trading limits.

- GDPR (for apps in the European Union): This involves protecting user data and adapting to the needs of different countries.

- Know Your Customer and Anti-Money Laundering policies: Use digital verification to make compliance easier and help with user onboarding.

It’s important to consult legal experts from the start to build compliance in your app. Regularly update your knowledge of current regulations to avoid penalties and build user trust.

Step 3: Include Core Features

A stock trading app should combine useful features with ease of use. The main features include:

- User Registration and Authentication: Users can register safely with multi-factor authentication and biometric logins. OAuth should be used to access other platforms.

- Portfolio Management: Users can track their investments, returns, and risk profiles. This feature includes graphs and historical data comparisons to show performance.

- Trading Functionality: Users can buy and sell stocks, ETFs, and other instruments in real time. Include advanced order types like stop-loss and limit orders for experienced traders.

- Market Data: Users get live stock quotes, charts, and news. They can create customizable watchlists to track their favorite assets.

- Push Notifications: Users receive alerts for price changes, order execution, or important market news. They can customize these notifications to avoid irrelevant updates.

- Advanced Analytics: The app offers tools for technical and fundamental analysis, such as RSI, MACD, and moving averages. Include strategy backtesting to attract experienced traders.

- Social Trading: Users can follow and copy trades made by experienced investors. This feature encourages community engagement and helps beginners learn.

Step 4: Choose the Right Tech Stack

The choice of technology stack affects how well your application performs, scales, and how users interact with it. Here’s a standard tech stack to consider:

- Front End: Use React Native or Flutter to ensure your app works on both iOS and Android platforms. Make sure it offers smooth animations and a responsive design.

- Back End: Choose Node.js, Python, or Java for strong server-side capabilities. Frameworks like Django or Spring Boot can help speed up development.

- Data Storage: Use PostgreSQL or MongoDB for efficient data storage and retrieval. Implement caching tools like Redis to make data access faster.

- Financial Data APIs: Integrate APIs like Alpha Vantage, IEX Cloud, and Yahoo Finance. Also, add payment and identity verification APIs.

- Cloud Service: Use AWS or Google Cloud for scalable infrastructure. Implement load balancers to handle peak usage times.

Ensure that your tech stack choices align with your app’s growth plans and meet user expectations.

Step 5: Design the UI and UX

A smooth user experience can make or break your application. To keep it simple and attractive, you should use clean and simple designs. Avoid clutter and focus on elements that help guide the user. Make navigation easy. Use breadcrumb trails and clear calls to action to improve usability. Offer personalization options, like customizable dashboards. Let users choose themes, notification settings, and the data they want to see. Ensure accessibility for users with disabilities. The website should include features like voice commands and adjustable text sizes. Conduct user testing with different types of users to improve the interface, and provide regular updates based on feedback and new trends.

Step 6: Implement Security Measures

Since financial data contains sensitive information, security is very important. Here are some key actions to take:

- Encrypt Data: Use SSL/TLS protocols to encrypt data during transmission. Implement end-to-end encryption for sensitive user information.

- Safe APIs: Regularly test your APIs for weaknesses. Apply rate limits and authentication to stop users from abusing them.

- Fraud Detection Systems: Use machine learning to spot and prevent fraud by identifying unusual patterns in login attempts or trading behavior.

- Periodic Security Audits: Conduct regular penetration testing and code reviews. Stay updated on new vulnerabilities and fix them promptly.

- User Education: Teach users about best practices, like creating strong passwords and avoiding phishing scams, to help improve security.

Step 7: Development and Testing

Use Agile methodology to stay flexible and make improvements over time. The key steps are:

- Prototyping: Create a Minimum Viable Product (MVP) to test the main idea. Use wireframes and mockups to get early feedback.

- Development: Write clean, modular code that is easy to update. Focus on making code reusable and ensuring there is good documentation for easier maintenance later.

- Testing: Combine manual and automated testing to ensure:

– The application works without bugs. Test edge cases and check the app in different scenarios.

– It works well on different devices and platforms. Test the app on various operating systems and screen sizes.

– It performs well under heavy use. Simulate high usage to find bottlenecks and optimize resource use.

– User feedback from beta testing helps improve the app before the final release.

Step 8: Deployment and Maintenance

Once the app is tested and ready, launch it on app stores like Google Play and the Apple App Store. After the launch, focus on:

- Quickly responding to user feedback and issues. Use analytical tools to track user behavior and find areas for improvement.

- Regularly updating the app with new features and security patches. Clearly communicate these changes to users.

- Increasing server resources as the number of users grows. Use cloud-based auto-scaling features to handle traffic spikes.

Be proactive in keeping the app running smoothly and reliably for users.

Monetization Strategies for Stock Trading Apps

Over the past several years, the rise of stock trading apps has made financial markets accessible to many more people. To ensure they succeed and grow, these apps need to find effective ways to make money. Let’s look at some common and innovative strategies that stock trading apps use to earn revenue:

{1} Commission Fees on Trades

Many trading services are now moving to commission-free trading. However, some still charge for specific trades or premium services. You may see charges for options trading, foreign securities, or rarely traded financial instruments. This model can still work for specialized trading sites.

{2} Payment for Order Flow (PFOF)

Many commission-free trading apps make money through Payment for Order Flow. In this, brokerages get paid by market makers for sending trade orders their way. It allows apps to offer commission-free trading to users.

{3} Subscription Plans

Most trading apps offer subscription plans for steady revenue. Premium accounts often provide advanced analytics, real-time market data, educational resources, and priority customer resources. Serious investors and traders typically pay for these extra tools and insights.

{4} Margin Lending

Margin trading lets users borrow money to increase their trades. Platforms that offer this service charge interest on borrowed funds, making it a valuable revenue source. Although the rates can be competitive, they add up for active traders using leverage.

{5} Interest on Cash Balances

When user deposit money into their trading accounts, but don’t invest it right away, that cash can stay idle. The trading platform can earn interest on that cash if it invests in low-risk financial options. While individual returns may be small, they can accumulate across millions of accounts.

{6} Educational Content and Courses

Many apps generate revenue by selling premium educational content, such as paid courses, webinars, and certifications. These resources are helpful for new investors who want to learn and feel confident before trading. The mix of education and trading tools creates a strong ecosystem.

{7} Advertising and Affiliate Marketing

Targeted advertising and affiliate marketing from financial service providers can also generate revenue by allowing them to place their ads in exchange for money.

{8} In-App Purchases

Some services charge for advanced tools and features as one-time in-app purchases. Examples include proprietary trading algorithms, AI-driven investment suggestions, or enhanced charting capabilities. This approach suits users who prefer not to commit to a subscription.

Legal Issues to Consider in While Creating a Stock Trading App

[1] Regulatory Compliance

Stock trading apps must follow strict rules:

- Licenses: Obtain necessary licenses from financial authorities like the SEC or FCA. Partnering with a licensed broker is necessary.

- User Verification: Verify users’ identities to prevent fraud and comply with anti-money laundering rules (KYC).

[2] Data Privacy and Security

To protect users’ sensitive information, robust measures are needed:

- Data Protection Laws: Follow laws like GDPR and CCPA.

- Encryption: Encrypt all user data and transactions.

- Privacy Policies: Clearly explain how user data is used and stored.

[3] Terms of Use and User Agreements

Clearly define rights and responsibilities:

- Risk Notification: Inform users about the risks of stock trading.

- Dispute Resolution: Describe how disputes will be handled.

[4] Intellectual Property (IP) Protection

Protect the app’s intellectual property:

- Trademarks and Copyrights: Safeguard the app’s brand and content.

- Third-Party Licenses: Ensure all third-party software and APIs are properly licensed.

[5] Regulations on Payment Processing

Ensure safe money transactions:

- PCI DSS Compliance: Safeguard payment card information.

- Third-Party Gateways: Confirm that third-party payment processors follow regulations.

[6] Taxation Laws

Understand tax implications:

- Capital Gains Tax Reporting: Help users report gains and losses.

- Corporate Tax Compliance: Follow tax laws in areas of operation.

[7] Marketing and Advertising Regulations

Advertise honestly:

- Truthful Advertising: Avoid false claims about profits or capabilities.

- Target Restrictions: Do not target minors or vulnerable groups.

[8] Liability and Risk Management

Limit legal exposure:

- Insurance: Acquire professional advice and cyber liability insurance.

- Disclaimer: State limits on liability for user errors or market losses.

[9] Cross-Border Challenges

Address international issues:

- Domestic Laws: Comply with each state’s financial regulations.

- Data Localization: Host data locally when required.

Latest Tech Features to Consider in Stock Trading Apps

[1] AI Insights and Predictions

Modern trading apps use Artificial Intelligence to help you make better decisions. They provide:

- Actionable insights: AI analyzes market trends and news in real-time to give you stock recommendations.

- Risk management: AI tools evaluate your portfolio’s risk and help you diversify.

- Predictive analysis: Apps use historical data to predict stock performance. They can identify underperforming stocks or suggest growing industries, allowing you to make quicker decisions.

[2] Real-Time Data Integration

Speed is crucial for stock trading. Advanced trading apps now offer:

- Ultra-low latency data feeds: You get real-time stock prices, market news, and fast trade execution.

- Integrated news: Apps gather global financial news and use sentiment analysis to show important events. This helps you act on market changes quickly.

[3] Customizable Dashboards and Analytics

Today’s investors need options. Trading apps include:

- Drag-and-drop widgets: You can customize your dashboard to show the charts, news, or watchlists you care about.

- Advanced charting tools: Easily overlay indicators, compare stocks, or backtest strategies.

[4] Fractional Trading and Micro-Investing

Investing is more accessible than ever due to fractional trading. Features include:

- Buy stock slices: You can buy fractions of expensive stocks like Amazon or Tesla, making it easier to diversify.

- Round-up investing: Automatically invest spare change from purchases. This opens investing to more people, especially young or first-time investors.

[5] Social Trading and Community Features

Apps are adding social features to encourage collaboration:

- Copy trading: You can follow and replicate successful investors’ portfolios.

- Discussion forums and peer insights: Connect with other traders to share strategies and discuss trends.

- Leaderboard ranks: Track your performance against others in the app.

[6] Voice and Gesture Controls

Smart assistants are becoming part of trading platforms:

- Voice command: You can make trades, set alerts, or get analytics by speaking to your device.

- Gesture controls: On smartwatches, you can perform quick actions like checking your portfolio or buying stocks with a simple swipe.

Cost of Developing a Stock Trading Application

[1] Basic Stock Trading App ($10,000 to $30,000)

- Features: This app will have essential features like user login, portfolio management, stock search, and basic trading options.

- Tech Stack: It will use a simple back end with basic database integration and an easy-to-navigate front end.

- Target Audience: This app is designed for beginner investors or small businesses.

- Development Period: The development will take 2 to 3 months.

[2] Medium-complex Application ($30,000 to $80,000)

- Features: This app will provide more advanced tools, including charting, technical analysis, real-time market data, live notifications, risk management tools, and support for multiple devices.

- Tech Stack: It will integrate third-party APIs for real-time data and use more complex security measures, alongside a scalable back end.

- Target Market: This app is suitable for retail traders and financial advisors.

- Development Period: This app will take 4 to 6 months to develop.

[3] Premium Advanced Application ($80,000 to $200,000+)

- Features: This app will include advanced stock trading features like AI-driven suggestions, fast trading algorithms, cryptocurrency options, and detailed analytics dashboards.

- Tech Stack: It will use a highly scalable framework, artificial intelligence models, and strong security protocols suitable for businesses.

- Target Audience: This app targets corporate investors and professional trading companies.

- Development Duration: It will take 6 to 12 months or more to develop.

Tech Stack for Stock Trading App Development

[1] Frontend

- Frameworks: Angular/ React.js

- State Management: Redux/ Context API/ MobX

- UI Tools: Material Design/ Ant Design/ Chakra UI

- Charting Libraries: Chart.js/ D3.js/ Highcharts

[2] Backend

- Languages: Python/ Node.js/ Java

- Databases: PostgreSQL/ MySQL, MongoDB/ Redis

- Real-time Communication: WebSockets/ Socket.IO

- API Gateway: GraphQL/ RESTful APIs

[3] Real-Time Data Integration

- Market Data Providers: Alpha Vantage/ Yahoo Finance/ Polygon.io

- Streaming Services: Kafka/ RabbitMQ/ AWS Kinesis

[4] Security

- Authentication/ Authorization: OAuth 2.0/ JWT/ Okta

- Data Encryption: TLS/ SSL, AES-256

- Fraud Detection: Scikit-learn/ TensorFlow/ PyTorch

[5] Infrastructure

- Cloud: AWS/ GCP/ Azure

- CICD Pipelines: GitHub Actions/ GitLab CI/CD/ Jenkins

- Containerization: Docker, Kubernetes

- Monitoring/ Logging: Prometheus/ Grafana/ ELK Stack

[6] Analytics

- Data Warehousing: Snowflake/ BigQuery/ AWS Redshift

- Visualization: Tableau/Power BI/ Looker

[7] Payment Gateway

- Integration: Stripe/ PayPal/ Plaid

- Compliance: PCI DSS Standard

[8] Testing

- Unit Testing: JUnit/ pytest/ Jest

- End-to-End Testing: Cypress/ Selenium/ Appium

- Performance Testing: JMeter/ Locust

How to Select a Stock Trading App Development Company in 2025?

To find the right stock trading application development company in 2025, you will need to balance careful research with a focus on innovation. The stock market is now highly digital and competitive. You need a partner who knows the technical details and aligns with your business goals. Next Olive Technologies have a global presence and provides stock trading mobile app development services in over 20 countries like the UAE, USA, and UK, etc. They are known for creating user-friendly and feature-rich trading platforms for beginners and experienced investors. Look for a company prioritizing strong security, a positive user experience, and the ability to grow with your needs. Next Olive has more than 12 years of experience in stock trading application development and has over 100 stock trading app developers. Check out their portfolio to see if they can integrate features like AI-driven analytics, real-time market updates, and personalized dashboards. Also, choose firms with a proven record of following finance regulations. This will help ensure your app meets and exceeds industry standards. Good communication during and after the app’s launch is crucial for a successful partnership.

Conclusion

In conclusion, developing a stock trading app connects users with the financial world and uses technology to make it better. In simple terms, it’s about creating an app that helps both experienced investors and beginners confidently engage with the market. This process requires a focus on user-friendly design, strong security, and smooth integration with financial data providers. More than just a technical product, the app should create a trustworthy experience that makes complex information easier to understand and keeps up with changing market conditions. In today’s fast-paced markets, a good trading app is not just a tool; it acts as a partner for growth. For developers, this means they should not only focus on coding but also imagine a tool that combines innovation with ease of use, planning with reliability, and ambition with user trust.

Frequently Asked Questions

What are the essential features required to build a stock trading app?

Portfolio tracking, market news integration, smooth trade execution, advanced charting tools, risk management alerts, account funding, and secure registration will have to be integrated. Such an application may even engage the user further through additional features like AI-based investment insights and social trading.

How do you ensure real-time data accuracy in stock market investment app development?

Achieve this through integrating APIs from reliable financial data providers such as Alpha Vantage, IEX Cloud, or Yahoo Finance. In addition, you also ensure low-latency connectivity with stock exchanges so your app can deliver updates on time.

What security measures are necessary for a stock trading app?

Sensitive user data and secure financial transactions. There are essential security features for trading apps including data encryption (most commonly TLS/SSL), two-factor authentication, secure API integration, data tokenization, penetration testing at regular intervals, and compliance with all financial regulations such as GDPR and PCI DSS.

Can I integrate AI or machine learning when building a stock trading app?

Integration of AI or machine learning will significantly enhance your stock trading application. AI will analyze market trends, provide stock performance predictions, and make tailor-made investment recommendations. Machine learning will further refine fraud detection and automate trading strategies as per user preference.

How long does it take to build an investment app?

It takes a basic a fully developed and functional trading application, in all its craziness, takes between 3-6 months for the simpler app, while several advanced features, such as real-time analytics with AI recommendations and multiple security can take 6-12 months.

What compliance is key in developing a stock market investment app?

Follow the financial laws such as SEC regulations in the United States, MiFID II in the European Union, and similar regional frameworks. Protocols for Know Your Customer and Anti-Money Laundering are also required.

How can I create revenue from a stock trading application?

Through subscription fees, trade commissions, premium features like better analytics, ads, referral programs, or agreements with others such as financial institutions or advisors, customers may monetize their app through various means.

Is it possible to integrate cryptocurrency trading in a stock trading app?

Yes, to attract a wider audience, many stock trading apps have already included some form of cryptocurrency trading. This necessitates a cryptocurrency exchange development along with conformity with various cryptocurrency-related regulations and ensuring an online wallet is secured for transactions.

How can I keep users engaged after launching a stock trading app?

Personalized investment alerts, gamification features like achievement badges, and financial news integration, social trading options, and regular updates to keep users returning to the app are some of the ways to engage users.

What is a user-friendly design for an investment app in a stock market?

Intuitive charts, dashboards, etc. Complex trading made simple through guided workflows, clear actionable insights for every kind of user. Anti-phishing and anti-pharming techniques for developing stock frameworks like React or Angular, is ideal. Scalability is provided by cloud services like AWS or Azure, and secure databases like PostgreSQL or MongoDB store the user and transaction data.