eWallet App Development Cost (2025)

How much does it cost to develop an eWallet App in 2025

Developing an eWallet application is an exciting opportunity for businesses looking to provide their users with fast, secure, and convenient digital payment solutions. Whether it’s enabling money transfers, paying bills, or overseeing transactions, eWallets have become a major part of daily life. However, like any technological solution, the eWalletapp development costs are influenced by various factors. The features you select, the platforms you aim for, the complexity of the design, and the location of your development team all significantly impact the overall cost. Understanding these factors in advance helps avoid unexpected costs and ensures a smoother pathway through the development process.

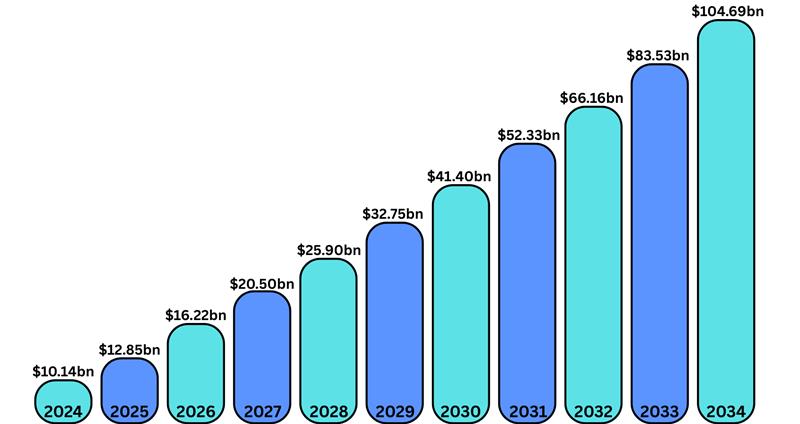

Global Market Statistics of eWallet Applications and Forecast

As per the report by Precedence Research, the global mWallet market cap in 2024 was $10.14 billion, and by the end of 2025, it is expected to be $12.85 billion. With a CAGR of 26.30%, the market cap could reach $104.69 billion by 2034.

Factors Affecting Digital Wallet App Development Cost

[1] App Features and Functionality

The number of features in a digital wallet app influences the amount of time and effort required for development, which directly increases the costs. Basic functionalities such as user registration, balance inquiries, and transaction histories are easier and cheaper to implement. In contrast, advanced features like QR code scanning, bill payments, loyalty programs, and multi-currency support demand more complex programming. These additional functions often necessitate tailored development and extensive testing.

[2] Platform Choice

Developing an app for a single platform, such as Android or iOS, is typically more cost-effective than creating one for both. If the app needs to function properly on both platforms, it generally requires either separate native development or the use of cross-platform tools. Although native applications offer superior performance, they are more costly due to the increased workload. Alternatively, cross-platform solutions like Flutter or React Native can be more economical but might face limitations in performance or native features.

[3] UI/UX Design Complexity

The aesthetic and functionality of an app significantly impact user satisfaction, and investing in quality UI/UX design increases development costs. A simple and minimalist design can be created more quickly, while highly customized interfaces with animations and unique layouts demand additional design hours. Digital wallet apps also require responsive navigation to enable secure transactions easily. A more visually appealing and seamless user experience requires more resources for planning, designing, and refining.

[4] Security and Compliance Needs

Digital wallet apps handle sensitive personal and financial information; security features are crucial rather than optional. Implementing measures such as data encryption, biometric authentication, fraud detection, and secure API integrations can greatly increase the cost. Furthermore, compliance with industry regulations like PCI-DSS or GDPR requires extra work from both legal and development teams. These safeguards are essential for earning user trust and preventing legal issues, but require specialized expertise and ongoing updates.

[5] Third-party Integrations

Digital wallet applications frequently integrate with external systems, including banks, payment gateways, or KYC verification tools. Each integration has its own set of specifications, APIs, and support systems that developers must understand and manage. Some of these services may charge fees or require licensing, adding to overall costs. Additionally, ensuring seamless operation among all components involves extra testing and debugging time, particularly when updates occur on either side.

[6] Development Team Location and Expertise

The location of the development team significantly influences costs. Developers based in North America or Western Europe generally charge higher fees than those situated in Asia or Eastern Europe. It’s essential to balance cost with expertise. Hiring skilled developers specialized in fintech reduces bugs and enhances performance, which can lead to cost savings over time. While hiring a more affordable team may seem appealing initially, it could result in higher maintenance costs in the long run.

[7] Maintenance and Updates

Once the app is launched, ongoing updates, bug corrections, and enhancements are crucial for maintaining a digital wallet app’s functionality. These continuous services require a dedicated team and a consistent budget. As technology advances and user feedback is gained, updates become essential for maintaining competitiveness. Ignoring this step can result in security vulnerabilities or user attrition, so it’s important to plan for ongoing maintenance.

[8] Testing and Quality Assurance

Comprehensive testing guarantees that the app performs effectively under various conditions, which is necessary for financial transactions. More complex applications require extensive testing across different devices, networks, and usage scenarios. This includes functional testing, performance assessments, and security evaluations. A more thorough testing process creates a superior final product, yet it also leads to increased development costs. This step is crucial to optimizing costs in the long run.

Digital Wallet App Development Cost Based on Types

[1] Closed eWallets

Closed eWallets are designed specifically for a particular brand or business, such as a shopping application or a food delivery service. These wallets only allow users to conduct transactions within that specific environment. Because the scope is limited and there are fewer integrations, the development costs are lower, ranging from $10,000 to $25,000 based on the features required. The design is more controlled, resulting in a faster and more cost-effective process for companies focusing on a brand-specific payment solution.

[2] Semi-Closed eWallets

Semi-closed eWallets offer users increased flexibility, enabling payments across various stores or platforms while still maintaining some limitations. These applications often require robust security measures and merchant integration, which can increase development costs. Generally, creating one app can cost between $20,000 and $50,000. Costs increase when adding functionalities like real-time notifications, loyalty programs, or smooth checkout options across affiliate platforms.

[3] Open eWallets

Open e-Wallets provide the best flexibility, allowing users to send, receive, and withdraw funds directly from their bank accounts. These wallets must fully comply with financial regulations, have advanced security measures, and integrate banking APIs. Due to this complexity, development cost typically ranges from $50,000 to over $100,000. Long-term investments also increase due to ongoing maintenance and regulatory compliance.

[4] Crypto Wallets

Crypto wallets manage digital currencies such as Bitcoin and Ethereum, requiring strong blockchain integration and high-grade security features. They can be custodial or non-custodial, influencing the cost. Development costs usually start around $40,000 and can go over $100,000, especially if multi-currency support, QR scanning, and cold wallet features are included. These applications also require regular updates to remain aligned with evolving crypto protocols.

[5] Mobile Banking Wallets

Mobile banking wallets serve as an extension of traditional banking, giving users complete control over their accounts via their smartphones. These applications are complex, requiring bank-level security, encryption, and real-time synchronization with core banking systems. Development costs typically start from $50,000 and can go over $150,000 based on the project scale. The need for compliance with financial regulations and ongoing performance testing further contributes to the total cost.

eWallet Development Cost Based on Key Features

[1] User Registration and KYC

Safe registration features ID verification (KYC), which includes document uploads and facial recognition. This ensures adherence to financial regulations.

Cost: $3,000 to $7,000.

[2] Multi-Factor Authentication

Enhances security by integrating OTP, biometric login, and email verification. This minimizes risks related to fraud and account breaches.

Cost: $2,000 to $4,500.

[3] Add Money from the Bank/Card

Users have the option to connect their bank accounts or cards to deposit funds into their wallets. Integration with payment gateways (e.g., Stripe, Plaid) is necessary.

Cost: $4,000 to $8,000.

[4] Peer-to-Peer (P2P) Transfers

Allows users to send and receive money instantly to contacts or through phone numbers/QR codes. This feature includes transaction notes and history.

Cost: $5,000 to $9,000.

[5] Bill Payments and Utilities

Users can directly pay for electricity, water, internet, and other bills through the app. This requires integration with third-party APIs.

Cost: $4,000 to $10,000.

[6] QR Code Payments

Create and scan QR codes for quick transactions. It supports both static and dynamic QR formats.

Cost: $3,000 to $6,000.

[7] Split Payments

Users can share bills or expenses with friends. This includes reminders and suggestions for automatic splitting.

Cost: $2,000 to $5,000.

[8] In-App Chat Support

Integrated chat with an AI bot and the option to escalate to a live agent. This feature assists users in resolving issues without leaving the app.

Cost: $4,000 to $7,000.

[9] Loyalty and Cashback Rewards

Introduces a gamified cashback system, a points program, and loyalty tiers to boost user engagement. It can be associated with partner stores.

Cost: $3,500 to $6,500.

[10] Virtual Card Generation

Provides instant creation of virtual debit/prepaid cards for online transactions. Bank or card issuer integration is required.

Cost: $6,000 to $12,000.

[11] Transaction History and Analytics

Offers detailed logs with filters, graphs, and categories for spending. This helps users monitor their expenses.

Cost: $2,500 to $5,500.

[12] Push Notifications and Alerts

Sends real-time notifications for transactions, promotions, and suspicious activities. It includes support for rich media.

Cost: $1,500 to $3,000.

[13] Digital Receipts and Invoicing

Automatically generates receipts for each transaction. Users can download or email invoices.

Cost: $2,000 to $4,000.

[14] Multi-Currency Support

Enables users to hold and conduct transactions in various currencies. This requires an FX rate API and wallet conversion logic.

Cost: $5,000 to $10,000.

[15] Recurring Payments & Subscriptions

Enables scheduled payments for rent, subscriptions, or EMIs. It manages recurring payment schedules and retry mechanisms. Cost: $3,000 to $6,000.

[16] Merchant Onboarding and Dashboard

Allows businesses to register, accept payments, and access sales analytics. This is beneficial for increasing B2B adoption.

Cost: $6,000 to $12,000.

[17] Geo-Fencing Offers

Provides location-based promotions and notifications when users are near participating merchants.

Cost: $3,500 to $7,000.

[18] Wallet-to-Wallet Crypto Transfers

Allows users to send and receive cryptocurrency using wallet addresses or QR codes. Blockchain integration is required.

Cost: $8,000 to $15,000.

[19] Card Tokenization for Security

Hides sensitive card information with encrypted tokens. This ensures PCI compliance and helps prevent fraud.

Cost: $4,000 to $8,000.

[20] AI-Powered Expense Insights

Utilizes machine learning to categorize expenditures, recommend budgets, and identify unusual activities. Cost: $5,000 to $10,000.

Cost to Integrate Emerging Technologies in eWallet Software Development

[1] Artificial Intelligence (AI)

Integrating AI into an eWallet app enhances its functionality. It enables features such as chatbots for customer support, fraud detection, and personalized offers. The cost depends on the complexity of the AI features and the user base. A simple AI integration, like a chatbot, may cost less, whereas complex AI systems for real-time fraud notifications or spending forecasts can increase costs. This technology also requires ongoing updates and monitoring, contributing to continued expenses. Cost: $8,000 to $20,000.

[2] Machine Learning (ML)

ML enables your eWallet to understand user behavior and enhance its performance over time. It is utilized to identify trends, detect unusual transactions, and even analyze spending patterns. Costs are based on the volume of data that needs processing and the complexity of the algorithms. A basic recommendation engine might be at the lower end of the pricing scale, while real-time behavioral analysis tends to be more costly. Moreover, ML models must be trained, tested, and retrained, which consumes both time and financial resources. Cost: $20,000 to $50,000.

[3] Blockchain

Blockchain technology provides a great level of security and transparency to eWallets. It is frequently employed for digital currency transactions and secure identity verification. The integration cost is higher because it requires skilled developers and extensive backend configuration. This may also include creating smart contracts or establishing a private blockchain network. It represents a valuable but pricier option for fintech applications that manage sensitive information and large transactions. Cost: $20,000 to $50,000.

[4] Cloud Technology

Cloud technology serves as the base for most applications, including eWallets. It helps in storing user data, managing app traffic, and scaling services as the user base expands. Cloud integration is relatively affordable, particularly when utilizing well-known providers like AWS, Google Cloud, or Azure. Costs include the initial setup, configuration, and potential migration from older systems, along with monthly usage fees based on storage and traffic. Cost: $5,000 to $15,000.

[5] Data Analytics

Data analytics helps companies understand user interactions with the app. It monitors spending patterns, transaction histories, and user preferences. This insight is crucial for enhancing the app and effectively targeting users with suitable features or offers. The costs arise from establishing dashboards, linking data sources, and generating custom reports. Additionally, it includes tools and services that analyze and visualize user behavior in real-time. Cost: $7,000 to $18,000.

How Next Olive Can Help You With Their eWallet App Development Services

Next Olive is the leading eWallet app development company with over 13 years of experience that simplifies the process of developing an eWallet app with their expert services. They recognize the needs of both businesses and users, simple payments, robust security, and a seamless experience. Their team is dedicated to designing user-friendly applications that perform quickly and look appealing on any device. Whether it’s sending money or managing transactions, everything is developed to function effortlessly. By choosing Next Olive, you’re not just getting an app; you’re partnering with a reliable service provider who takes care of all the technical aspects while helping you launch a dependable and highly secure digital wallet.

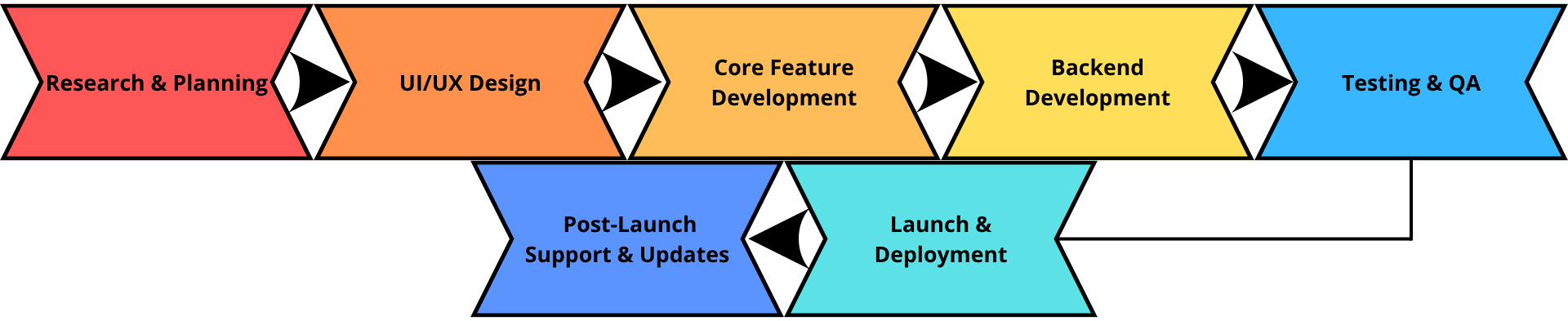

Follow a Step-by-Step eWallet Mobile App Development Process

Step 1: Research & Planning

Every successful app begins with a well-defined strategy. This stage involves clarifying the purpose of your eWallet app and identifying its potential users, such as small business owners, regular consumers, or travelers. Analyze what your competitors provide and brainstorm ways your app can differentiate itself. Additionally, it is crucial to decide on essential features like bill payments, peer-to-peer transactions, and cashback rewards. Selecting the appropriate technology stack and platforms is also part of this phase. A thoroughly crafted plan can save valuable time, effort, and financial resources later on.

Cost: $2,000 to $5,000.

Step 2: UI/UX Design

The user interface and experience design aims to create an app that is simple, engaging, and user-friendly. A quality design not only looks good but also enables a seamless process for users to navigate from one action to the next. Designers create wireframes and interactive prototypes to evaluate the app’s usability. Elements such as color palettes, typography, button configurations, and animations are carefully selected to keep users interested and minimize confusion. The objective is to build confidence and security in users while they engage with your eWallet.

Cost: $3,000 to $7,000.

Step 3: Core Feature Development

At this stage, your app begins to take form. Developers create the front end and link it to the essential functions of your eWallet. These features might involve account creation, secure logins, adding funds to the wallet, sending and receiving money, and accessing transaction records. Some applications may also offer bill payments, QR code scanning, loyalty rewards, and additional functionalities. Security measures like fingerprint login and OTP verification are implemented during this phase. Creating dependable, seamlessly operating features is essential for building user trust.

Cost: $10,000 to $30,000.

Step 4: Backend Development

The backend functions as the core of the app. It manages everything, such as processing user information, handling transactions, communicating with third-party services such as banks or payment processors, and saving digital receipts. Developers utilize programming languages and tools to develop a scalable, high-performance server architecture. APIs are integrated to enable the app’s communication with external services such as PayPal, Stripe, or banks. Data encryption and real-time updates are also addressed here to ensure speed and security. Cost: $8,000 to $50,000.

Step 5: Testing & QA

Before launching the app publicly, extensive testing is important. Quality assurance (QA) teams carefully examine every screen, button, and functionality to verify they perform as intended. They conduct tests across various devices and screen sizes to ensure compatibility. Any bugs, glitches, or slow loading times have been resolved. The team also executes stress testing to assess how the app behaves during high usage periods, and security testing is performed to avoid data breaches or hacking attempts. This step is vital to ensuring a smooth, error-free user experience.

Cost: $3,000 to $8,000.

Step 6: Launch & Deployment

Once development and testing are complete, it’s time to release the app. The app gets submitted to the Apple App Store and Google Play Store, which includes preparing descriptions, screenshots, and complying with store guidelines. You might encounter a waiting period for approvals and may need to make minor adjustments based on feedback. After going live, the app should be closely monitored for performance hiccups and user feedback. Conducting a soft launch or beta test with a limited user group is also advisable before the full public release.

Cost: $1,000 to $3,000.

Step 7: Post-Launch Support & Updates

After the release, continuous maintenance is essential to ensure the app functions effectively. This includes addressing any emerging bugs, enhancing features based on user suggestions, and refining security measures. Updates may be necessary with new OS versions as well. Additionally, adding new features over time can help maintain your competitive edge. Consistent customer support ensures users can resolve issues quickly and develop their loyalty to your app.

Cost: $1,500 to $5,000.

Select an Appropriate Technology Stack to Create Mobile Wallet

[1] Frontend Development

Mobile App Languages/Frameworks:

- React Native

- Flutter

- Swift

- Kotlin/Java

Web App Languages/Frameworks:

- React.js / Vue.js / Angular

- HTML5, CSS3, JavaScript/TypeScript

[2] Backend Development

Languages & Frameworks:

- Node.js with Express.js

- Java with Spring Boot

- Python with Django or FastAPI

- Go

- .NET Core

API Management

- RESTful APIs / GraphQL

- API Gateway (e.g., Kong, AWS API Gateway)

[3] Databases

- PostgreSQL

- MySQL

- Microsoft SQL Server

- MongoDB

- Redis

- Cassandra

[4] Authentication & Authorization

- OAuth 2.0 / OpenID Connect

- JWT (JSON Web Tokens)

- Firebase Authentication

- Biometric authentication

- Multi-Factor Authentication (MFA)

[5] Payments & Financial Integrations

Payment Gateways/APIs:

- Stripe / PayPal / Razorpay / Adyen / PayU

- Bank APIs (using Open Banking / Plaid / Yodlee)

Card Processing:

- Visa / Mastercard SDKs

- NFC & QR Code APIs

- Apple Pay, Google Pay integration

- QR code generation (Zxing, QRCode.js)

[6] Security

Encryption:

- TLS 1.2+/SSL

- AES-256

Secure Storage:

- Android Keystore / iOS Keychain

- Tokenization

Fraud Detection Tools:

- Sift, Kount, Riskified

Penetration testing tools:

- OWASP ZAP, Burp Suite

[7] Infrastructure & DevOps

Cloud Providers:

- AWS / Google Cloud Platform / Azure

CI/CD Tools:

- GitHub Actions, GitLab CI, Jenkins

Containerization & Orchestration:

- Docker, Kubernetes (K8s)

Monitoring & Logging:

- Prometheus + Grafana

- ELK Stack (Elasticsearch, Logstash, Kibana)

- Sentry

[8] Notifications

- Firebase Cloud Messaging (FCM)

- Apple Push Notification Service (APNs)

- Twilio / Nexmo for SMS

- In-app notifications system

[9] Testing

Unit & Integration Testing:

- JUnit / Mocha / Jest / PyTest

UI Testing:

- Appium, Detox, Espresso, XCUITest

Security Testing:

- OWASP ZAP, Burp Suite

Performance Testing:

- JMeter, Locust

[10] Analytics & User Behavior

- Mixpanel / Amplitude

- Google Analytics / Firebase Analytics

- Segment

Monetization Tips for eWallet Applications

[1] In-App Advertisements

eWallet applications can generate consistent revenue by displaying relevant advertisements within the app. These can include banner ads, videos, or promotional deals from partner businesses. As users tend to spend a significant amount of time in the app, advertisers are willing to pay for it. It’s crucial to ensure that the ads don’t disrupt key actions like sending or receiving money.

[2] Transaction Fees or Commissions

A small charge for specific transactions can become a good source of revenue. For example, applying fees when users transfer money instantly or exceed a certain free limit works effectively. Even a minor commission per transfer can accumulate quickly if the app has a large user base. Typically, users are willing to pay a nominal fee for speed and convenience.

[3] Subscription

Providing premium features through a monthly or annual subscription option allows users to choose an upgrade. Additional features like priority support, increased transfer limits, or exclusive offers can make the subscription appealing. A free version keeps basic users satisfied, while the paid option ensures consistent income. The main factor is to deliver genuine value in exchange for the fee so that users feel it’s worth their investment.

[4] Merchant Fees

When businesses utilize the eWallet for payment processing, a small fee can be charged for each transaction. This approach is common among most digital wallets today. Merchants appreciate the quick payment and access to an expanding customer base, so they are often accepting of this fee. Over time, this can develop into a significant revenue stream for the app, particularly with high-volume merchants.

[5] Currency Conversion Fees

For users traveling or shopping internationally, currency conversion is often necessary. Implementing a small fee for this service allows the app to cover exchange costs and still earn a profit. This charge is typically integrated into the transaction and is shown as a convenience fee. As it is part of the international purchasing process, users usually expect it.

[6] In-App Purchases

Offering minor add-ons within the application, such as gift cards, reward boosts, or payment themes, can provide additional income. These features are optional, so users don’t feel forced to purchase, but many appreciate the extra features. It’s a simple way to earn money while enhancing the user experience. The more innovative and beneficial these add-ons are, the better they tend to perform.

How to Optimize eWallet App Development Cost?

[1] Start with a Clear Objective

Having a clear idea from the start greatly impacts the process. Before you start development, highlight the key features necessary for your eWallet app. Keep the initial version simple, just include essential functions like money transfers, wallet balance viewing, and transaction history. Steer clear of integrating too many advanced features at the start, as they can increase costs. A well-defined strategy reduces confusion and saves both time and resources.

[2] Choose the Right Development Company

The team you choose to create your app significantly influences the total expenses. Whether you opt for an in-house team, a freelancer, or a digital wallet app development company, ensure they understand your objectives and budget constraints. While experienced teams may charge more initially, they often create better outcomes quickly. Additionally, outsourcing to locations with lower development costs can be a wise choice, provided it’s managed effectively.

[3] Use Pre-Built Modules and APIs

Pre-built and open-source modules are highly cost-effective. Features such as user authentication, payment processing, and notifications can often be integrated using available APIs or SDKs. These resources are dependable and can significantly reduce both time and expenses. Leveraging pre-made modules allows your development team to focus on the unique aspects of your app, rather than redeveloping existing functionalities.

[4] Focus on One Platform First

Launching on both iOS and Android at the same time may seem appealing but can be costly. It’s generally easier to start with one platform, gather user reactions, and then broaden your reach. This approach saves on development costs while also allowing you to gather feedback for future improvements. Once the app demonstrates value, expanding becomes a more secure investment.

[5] Keep the Design Simple and User-Friendly

Elaborate graphics and animations might be visually appealing, but they can significantly increase your budget. A simple and engaging design that users can easily navigate tends to be more effective. In the early phases, emphasize functionality over visuals. Later, enhancements can be made based on actual user fe2edback if necessary.

[6] Test and Fix Early and Often

Ignoring the testing phase can result in costly issues afterward. Bugs and performance glitches identified post-launch are generally more expensive to resolve. Regular testing throughout development helps catch problems early, keeps everything on schedule, and ensures a seamless user experience. It’s a minor investment that safeguards the larger project

Conclusion

In conclusion, the eWallet app development cost has various elements such as features, design, security, choice of platform, and the location of the development team. Although the total cost can differ, planning and having a clear vision of your objectives can help in managing your finances effectively. Whether you are working on a simple digital wallet or a complex payment application, prioritizing quality, user experience, and long-term growth is essential. Collaborating with the right development team is also crucial for keeping costs manageable while ensuring quality. With the proper strategy, transforming your eWallet concept into a functional app is achievable.

Frequently Asked Questions

Which is the best digital wallet development company near me?

Next Olive is a reliable eWallet app development services & company with over 13 years of experience in the fintech domain. The company has a team of more than 100 eWallet app developers and has a firm presence in 20 different countries, such as the USA, UK, Australia, Saudi Arabia, and more.

What is the eWallet app development cost in 2025?

The cost to develop an eWallet app depends upon several crucial factors such as type, size, platform, and complexity.

- Basic App: $15,000 to $35,000.

- Medium-Sized App: $35,000 to $100,000.

- Large Apps: $100,000 to over $200,000.

How much time does it take to develop an eWallet app?

The time taken to fully develop an eWallet application depends upon factors such as type, size, and complexity of the app. Generally, it takes about 2 to 4 months for a small app, 4 to 6 months for a medium-sized app, and 6 to over 12 months for developing a high-complexity application.

Which methodology do you use to develop eWallet applications?

For most of the projects, we use Agile development approach as it enables flexibility in the whole development process and makes it easier to implement changes. For projects that have fixed requirements, we use Waterfall model.

0 Comments