A Complete Guide For eWallet App Development (2025)

How to Develop an eWallet Application?

In today’s rapidly evolving digital landscape, depending on cash or even traditional wallets is gradually becoming outdated. An increasing number of individuals are opting for eWallet applications for fast, convenient, and secure transactions, whether it’s for buying a coffee, settling bills, or transferring money to a friend. If you’ve ever considered creating your eWallet application but do not know how to begin, you’ve come to the right place. This guide will lead you through all the essentials of eWallet in a straightforward, clear, and approachable format to help you transform your idea into a fully functional application.

What is an eWallet App?

An electronic wallet app, commonly known as an eWallet, provides a convenient and simple way to manage and utilize your finances via your smartphone. Rather than searching for cash or cards, you can effortlessly pay for items such as groceries, online purchases, or even taxi fares with just a few taps or by scanning a QR code. These applications securely hold your money and typically link to your bank account or credit/debit card. They also allow you to quickly send or receive money from friends or family without the need to visit the bank. Many eWallets additionally provide rewards, cashback, and options for bill payments, making them an intelligent and practical way to handle your everyday expenses. It’s like having your wallet stored right on your phone, which is secure, quick, and always readily available.

What is eWallet App Development

eWallet app development involves creating a mobile application that allows users to digitally store and manage their finances without the need for cash or cards. Imagine it as a virtual wallet on your smartphone, where you can utilize it to make purchases in stores, transfer money to friends or family, pay bills, or shop online, all with just a few taps. It’s quick, and simple, and eliminates the need to queue or search for cash and coins. In the backend, developers integrate robust security measures to safeguard your funds and personal data. They also ensure that the app integrates seamlessly with banks, credit cards, and other payment platforms. The primary objective is to simplify everyday financial tasks, making them safer and more convenient for people of all ages, whether you’re paying for coffee or dividing a restaurant bill with friends.

Benefits of Having an eWallet for Your Business

[1] Faster Payments

Using an eWallet means you won’t have to wait for a long time for funds to appear in your account. Transactions occur instantly or within minutes, leading to improved cash flow and better management of your business. This also eliminates the need to chase customers for payments or stand in long bank lines. Just send and receive, and keep everything moving seamlessly.

[2] Improved customer Convenience

Consumers appreciate simple and fast payment options, and that’s what eWallets provide. Customers can easily scan a QR code or tap their smartphones to complete a payment; no cash, no cards, no issues. The easier the payment process is, the more satisfied your customers will be. When shopping or making payments is seamless, they’re likely to return to you again. It benefits both parties.

[3] Better Record Keeping

eWallets automatically track all your transactions in one centralized location. This allows you to see where your money is spent and received without having to check paper receipts or bank statements. When it’s tax time or you need to review your sales, all your data is properly organized and readily accessible.

[4] Reduced Risk of Theft and Fraud

Carrying cash or depending on physical cards has its risks, like loss, theft, or counterfeit bills. With an eWallet, your funds are securely stored in digital format, safeguarded by passwords and security measures. Additionally, many wallets offer quick locking or recovery features if something goes wrong. This way, your hard-earned money remains safer, and you can worry less about security concerns.

Types of eWallet / mWallet Applications

[1] Closed eWallets

Closed eWallets are linked to a specific brand or enterprise. The funds within them can only be used to make purchases from that particular retailer or service. For example, if you have money in your Amazon Pay wallet, it can only be spent on Amazon. These wallets are generally designed to simplify purchases for frequent customers.

[2] Semi-Closed eWallets

Semi-closed eWallets provide greater flexibility. You can utilize them at various shops and websites, as long as those businesses have partnered with the wallet provider. Platforms like Paytm or PhonePe in India are examples of this type. You can use them for online shopping, bill payments, or even at local merchants that accept them.

[3] Open eWallets

Open eWallets offer the highest level of flexibility. You can use them for online or in-store purchases, as well as send money to others or withdraw cash from ATMs. Typically associated with banks, such as PayPal or Apple Pay, they provide nearly all the features of a traditional bank account in a digital format.

[4] Crypto Wallets

Crypto wallets are used for storing and managing cryptocurrencies like Bitcoin or Ethereum. They operate differently from standard eWallets since they deal with digital currencies instead of traditional money. These wallets are primarily used by individuals involved in crypto trading or investment.

[5] Mobile Banking Wallets

Mobile banking wallets are applications offered by banks themselves. They allow you to manage your bank account directly from your mobile device, which includes checking balances, transferring funds, and settling bills. These wallets are highly secure and reliable because they are supported by banks.

Features to Include during Digital Wallet Development

In digital wallet app development, it is crucial to integrate from simple to advanced features that enable users to fully utilize the app and perform their tasks efficiently and easily:

[1] User Registration and Login

Enable users to register easily using their email or phone number. Streamline the login process with options like fingerprint or facial recognition to remove repetitive password entries.

[2] Secure Authentication

Implement additional security measures such as two-factor authentication (2FA). This ensures that only the authorized user can log in, protecting their finances and personal information from cyber threats.

[3] Link Bank Accounts and Cards

Provide users with a simple method to connect their bank accounts or credit/debit cards. They should be able to manage these links conveniently in one location to enable seamless payments and transfers.

[4] Balance Check and Transaction History

Allow users to view their account balance and track their spending. Displaying a comprehensive list of previous transactions and top-ups builds trust and keeps users informed.

[5] Send and Receive Money

Enable users to send or receive money instantly using a phone number, email, or QR code. This feature is frequently used, so it should be efficient and straightforward.

[6] Bill Payments

Helps users in paying their utility bills, such as for electricity, water, or internet, with their smartphones. Additionally, implement reminders to help them avoid missing payment deadlines.

[7] Mobile and DTH Recharge

Allow users to quickly recharge their mobile or television subscriptions in a matter of seconds. This saves time and encourages repeat usage of your app.

[8] In-App QR Code Scanner

Integrate a QR code scanner within the app for contactless payments at retail locations. This method is fast, secure, and increasingly popular.

[9] Push Notifications

Send notifications for each transaction, bill due date, or special offer. This keeps users informed in real time and helps build trust in your services.

[10] Reward Points and Cashback

Users appreciate rewards. Provide cashback, loyalty points, or discounts to keep users motivated and satisfied.

[11] Split Bill Option

Facilitate bill splitting among friends for dining out or shared expenses. This reduces confusion about money sharing and simplifies group payments.

[12] Budgeting and Expense Tracker

Help users understand their spending habits and where their money is going. Visual aids or summaries on a daily or weekly basis can promote better financial practices.

[13] Multi-Currency Support

If you’re targeting a global audience, implement support for multiple currencies. Allow users to convert or hold various currencies easily in their wallet.

[14] AI-based Fraud Detection

Utilize advanced technology to detect any unusual activity. If suspicious behavior is identified, the system can notify the user or temporarily suspend the account.

[15] Chat Support or Help Center

Offer users a convenient way to seek help, such as through live chat or a comprehensive FAQ section. This enhances efficiency and boosts their confidence in your app.

[16] Offline Mode or QR Payment Without Internet

Enable QR-based payments without requiring internet access for a limited time. This feature is particularly useful in rural or low-signal areas.

[17] Cardless ATM Withdrawals

Allow users to withdraw cash from partner ATMs without needing a physical card. This adds an extra layer of convenience.

[18] Subscription Management

Provide users with a centralized view of all their active subscriptions, like Netflix, Spotify, or gym memberships, allowing them to manage cancellations easily.

[19] Shared Wallet

Allow users to create joint wallets with family or friends. This is ideal for households or managing shared expenses together.

[20] App Personalization

Enable users to personalize the app’s appearance, such as changing themes, assigning nicknames to contacts, or prioritizing frequently used features. A customized experience helps users feel at home.

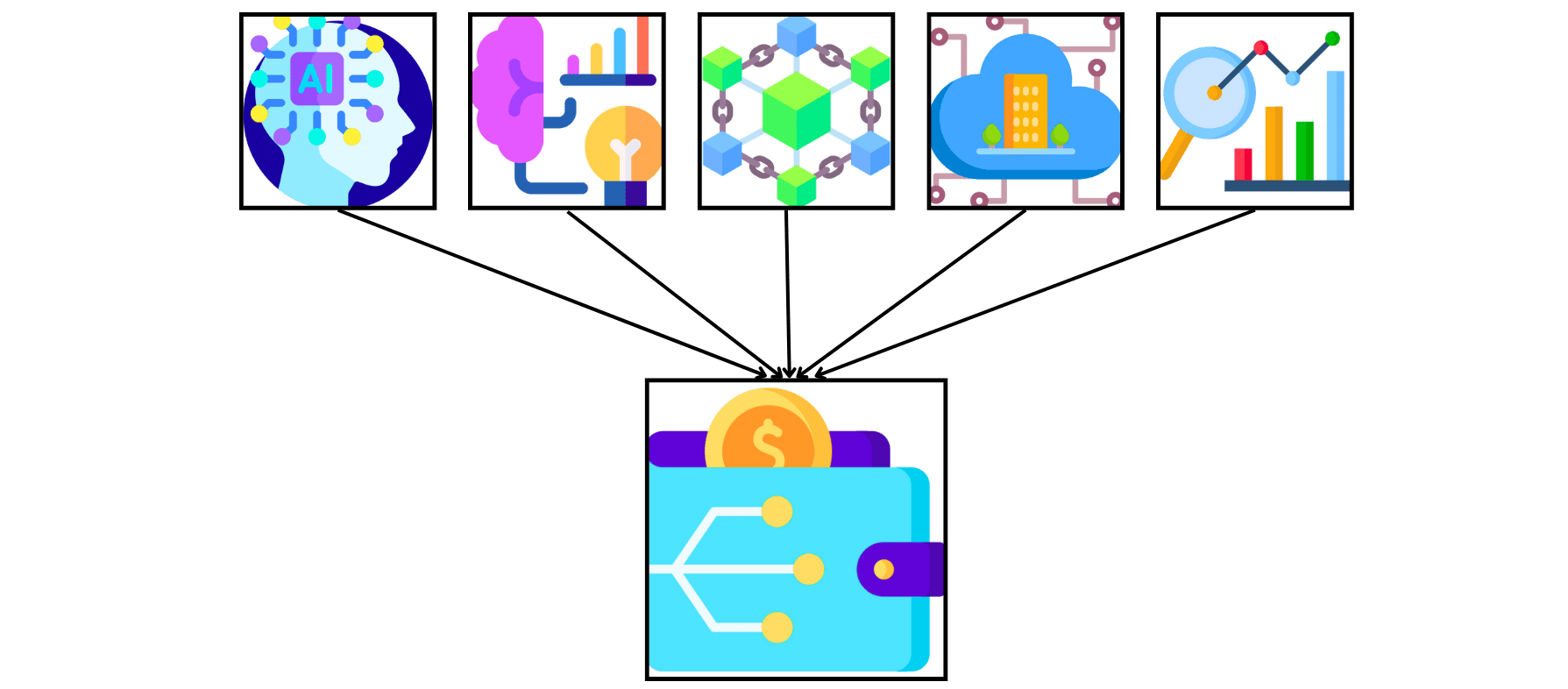

Emerging Technologies to Integrate into eWallet Apps

[1] Artificial Intelligence (AI)

Artificial Intelligence enhances eWallets, making them more intelligent and beneficial for users. It can offer suggestions, remind you of upcoming bills, and even identify any suspicious activity in your account. Think of it as a digital assistant quietly working to enhance your experience and ensure everything functions efficiently. AI enables eWallets to understand your behaviors over time, allowing for improved service.

[2] Machine Learning (ML)

Machine Learning operates like a brain that learns for eWallets. It observes your usage patterns, such as how frequently you pay bills or your typical shopping locations, and utilizes this information to deliver quicker, safer, and more tailored services. Additionally, ML can recognize patterns that help in fraud prevention, like identifying unusual transactions that are different from your regular behavior.

[3] Blockchain

Blockchain provides an additional layer of reliability and security for eWallet applications. It maintains your transactions in a digital record that is nearly impossible to alter or breach. This enhances the transparency and dependability of sending or receiving funds. With blockchain, you can have confidence that your money is being managed securely and honestly without the need for intermediaries.

[4] Cloud

Cloud technology enables eWallets to store your information and provide services over the internet rather than locally on your device. This allows you to access your wallet at any time and from any location, alleviating concerns about data loss if your phone is damaged. It also facilitates smoother and faster app performance with regular updates for new features.

[5] Data Analytics

Data analytics enables eWallet applications to analyze all the data collected from users. By analyzing this information, the app can reveal your spending patterns, assist you in managing your expenses, and even suggest ways to save. It transforms numerical data into valuable insights that simplify your financial management.

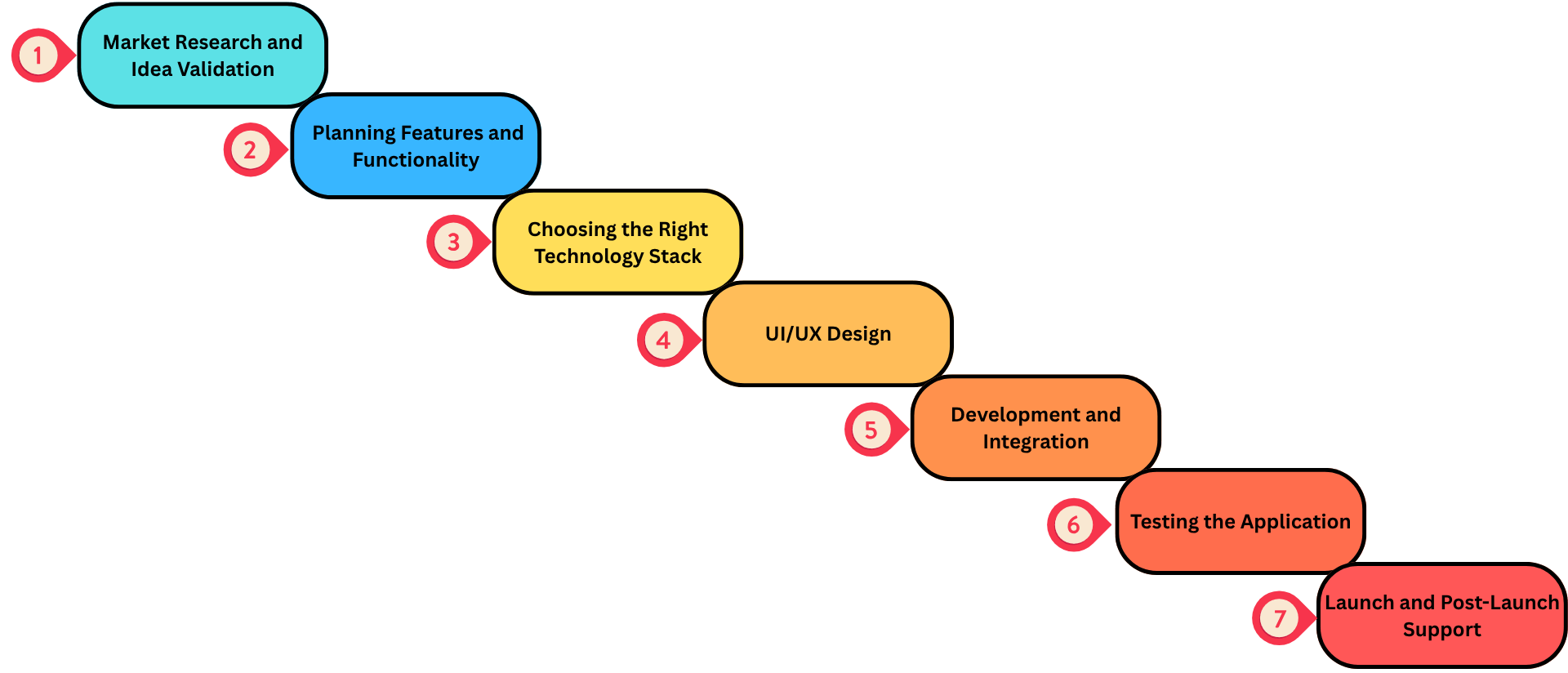

Step-by-Step Process of Digital Wallet App Development

Step 1: Market Research and Idea Validation

Before you create eWallet app, it’s essential to understand what users truly want in the application. Start by exploring current digital wallets such as Paytm, Google Pay, or Venmo. What functionalities do they provide? What issues are users facing? Engage with potential users and businesses to gather insights. The objective is to determine if your concept has an audience and how it can be enhanced or made unique from existing options.

Step 2: Planning Features and Functionality

After confirming that your idea is feasible, the next step is to determine the features your wallet app should have. In eWallet development, consider basic functionalities, such as transferring and receiving funds, linking bank accounts, making payments with QR codes, and maintaining a transaction history. You might also consider adding advanced functionalities like bill payments, rewards, or even cryptocurrency wallets. Always keep the users’ preferences and ease of use in focus while deciding what to include.

Step 3: Choosing the Right Technology Stack

This phase involves selecting the tools and platforms that your developers will utilize for eWallet software development. If you want the application to function on both Android and iOS, you might opt for cross-platform frameworks like Flutter or React Native. Additionally, you’ll need secure backend solutions to manage transactions, user information, and third-party connections. Prioritizing safety is crucial when choosing any technology.

Step 4: UI/UX Design

Users often favor applications that are simple to navigate and visually appealing. A simple, user-friendly design will help establish trust and encourage users to remain engaged with your wallet app. Designers will draft wireframes that are similar to blueprints and visual presentations for each screen, from registration to payment confirmation. Emphasize clarity, simplicity, and speed for users. The more seamless the user experience, the higher the chances of success.

Step 5: Development and Integration

At this stage, developers start coding the app according to the design and plan. This includes both the frontend, which is the visible part for users, and the backend, which is the underlying process. Key components such as payment gateway integration, Know Your Customer (KYC) processes, and data encryption are integrated. This phase also includes connecting with banks, third-party services, and setting up notifications, user accounts, and wallets.

Step 6: Testing the Application

Once the eWallet mobile app development is finished, it is crucial to conduct comprehensive testing of the app before its launch. Quality Assurance (QA) testers evaluate each feature to ensure proper functionality. They check for bugs, glitches, or anything that may confuse users. Security assessments are also performed to safeguard sensitive information such as banking details and passwords. The aim is to identify and resolve issues before real users interact with it.

Step 7: Launch and Post-Launch Support

Once everything is working fine, it’s time to deploy and launch your digital wallet app. You submit it to app stores and begin promotional activities. However, the work doesn’t end there. You’ll need to observe how users engage with the app, address their feedback, resolve bugs, and continuously update features. Ongoing assistance and enhancements are important for maintaining user satisfaction and loyalty.

Select a Robust Technology Stack to Create Mobile Wallet

[1] Frontend Development

Mobile App Development

Frameworks:

- React Native (cross-platform)

- Flutter (cross-platform)

Native:

- Swift (iOS)

- Kotlin / Java (Android)

Web Admin Dashboard

Frameworks:

- React.js

- Angular

- Vue.js

[2] Backend Development

Languages/Frameworks:

- Node.js (with Express.js or NestJS)

- Django (Python)

- Spring Boot (Java)

- Laravel (PHP)

- Go (Golang)

API Style:

- RESTful APIs

- GraphQL

[3] Databases

- PostgreSQL

- MySQL

- MariaDB

- MongoDB

- Redis

[4] Payment & Financial Services Integration

Payment Gateways:

- Stripe

- PayPal

- Razorpay

- Flutterwave

- Paystack

Banking APIs / Open Banking:

- Plaid

- Yodlee

- Salt Edge

Blockchain: Ethereum / Polygon SDKs

[5] Security & Compliance

- Data Encryption: AES-256, SSL/TLS

- Authentication: OAuth 2.0, JWT, biometrics (FaceID/Fingerprint)

- Two-Factor Authentication (2FA): Authy, Google Authenticator, PCI-DSS Compliance Tools

- Fraud Detection: Sift, Kount, custom ML

[6] Cloud Infrastructure & DevOps

Cloud Providers:

- AWS

- Google Cloud (GCP)

- Azure

Containerization & Orchestration:

- Docker

- Kubernetes

CI/CD:

- GitHub Actions

- GitLab CI

- CircleCI

Monitoring:

- Prometheus + Grafana

- New Relic

- Datadog

[7] Push Notifications & Messaging

Push Notifications:

- Firebase Cloud Messaging (FCM)

- Apple Push Notification Service (APNS)

In-app Messaging:

- Firebase

- Sendbird / Twilio

Email & SMS:

- SendGrid

- Twilio

- Amazon SES

[8] Analytics & Reporting

User Analytics:

- Firebase Analytics

- Mixpanel

- Amplitude

Business Intelligence:

- Metabase

- Tableau

- Power BI

[9] Testing

Unit Testing:

- Jest (JavaScript)

- JUnit (Java)

- PyTest (Python)

Integration / E2E Testing:

- Cypress

- Selenium

- Appium

eWallet App Development Cost in 2025

Several factors influence the cost to develop an eWallet app, such as:

[1] Features and Complexity

The greater the number of features integrated into your eWallet app, such as bill payment options, bank integrations, QR code scanning, or real-time alerts, the higher the building cost will be. Basic apps with simple functions are more affordable, whereas sophisticated features like AI chatbots or blockchain technology can increase expenses.

[2] Platform Choice

The decision on whether to launch your app on Android, iOS, or both will affect your financial plan. Developing for just one platform is typically less costly. If you opt for both, the expenses can double unless you utilize cross-platform development tools.

[3] Tech Stack Used

The selection of tools, programming languages, and frameworks by your developers is also significant. Some technologies are free and straightforward to work with, while others may come with licensing fees or require specialized expertise. Choosing an appropriate tech stack is essential for balancing cost and performance.

[4] Development Team Location and Size

The location of your development team greatly influences costs. Engaging a team from the US or Europe is typically more expensive than hiring one from Asia or Eastern Europe. Additionally, a larger team can enable quicker development but incurs higher costs.

[5] Design Complexity of UI/UX

If you aim for a sleek, responsive, and highly user-friendly design, it will require more time, effort, and financial investment. Simpler designs can be created more quickly and at a lower cost, though they may not leave a lasting impression on users. A more complex UI/UX requires skilled designers and extensive testing.

- Basic App: $10,000 to $60,000.

- Medium-Complexity App: $60,000 to $150,000.

- Large-Complexity App: $150,000 to over $350,000.

How to Select an eWallet App Development Company?

Selecting the right eWallet app development services & company can be very challenging, particularly due to multiple available options. It’s essential to find a team that not only comprehends your vision but also possesses the necessary technical expertise and experience to realize it. Select a firm that provides transparent communication, has a proven history of success, and offers tailor-made solutions that align with your business objectives. One such firm is Next Olive Technologies, a leading digital wallet app development company, which is recognized for its user-centered approach, extensive industry insight, and dedication to creating secure and trustworthy eWallet applications. Whether you’re a startup or an expanding business, Next Olive Technologies simplifies the process, assisting you in transforming your digital wallet concept into a fully operational app without the typical stress or confusion.

Conclusion

In conclusion, creating an eWallet application with a solid strategy, the right team, and appropriate tools is certainly achievable. From grasping the actual needs of users to ensuring the application is secure and user-friendly, every aspect is important. Always try to maintain simplicity, security, and ease of use. Whether you are launching a new app or enhancing an existing one, the key is to focus on addressing genuine issues faced by your users. With consistent efforts and the right assistance from a digital wallet development company, your eWallet app can significantly impact how individuals manage their finances daily.

Frequently asked questions (FAQs)

Which is the best eWallet application development firm near me?

You can consider Next Olive to make wallet app with the latest tools and technologies. The company has more than 13 years of experience and over 100 eWallet app developers. The firm also has expertise in Apple Wallet development and offers digital wallet development services in over 20 countries.

How much time does it take to develop a digital wallet app from scratch?

The time required to create a digital wallet depends upon several factors such as type, size, and complexity. Below is an estimated time required:

- Simple App: 2 to 3 Months

- Medium-Complexity App: 3 to 6 Months.

- Highly-Complex App: 6 to over 10 Months.

How many industries benefit from eWallets?

Numerous industries benefit from eWallet technology, such as IT, Manufacturing, Construction, Petroleum, Agriculture, Retail, FMGC, Logistics, Supply Chain, Transportation, etc.

0 Comments