A Complete Guide for Fintech App Development (2025)

Fintech App Development: Cost, process, and features

In today’s world, technology is growing at a fast rate. Many businesses are adopting technology to tackle real-world challenges. In the finance sector, fintech apps are revolutionizing how companies deal with various modern financial challenges using innovative and accessible solutions. In this guide, we will uncover the secrets behind fintech app development and learn about various types of fintech apps, the factors that affect the development and cost in 2025. Whether you are developing an investment platform or a banking app, it is important to learn the essential aspects of fintech mobile app development to create reliable and customer-centric solutions.

What is a Fintech App?

A fintech app is a mobile application or a web-based app that allows users to perform various finance-related operations such as money transfer, investment, etc. These apps aim to streamline finance operations and make them more accessible and efficient for the users. A fintech app enables seamless and secure transactions and provides ease of access to its users.

Global Statistics of Fintech Applications in 2025

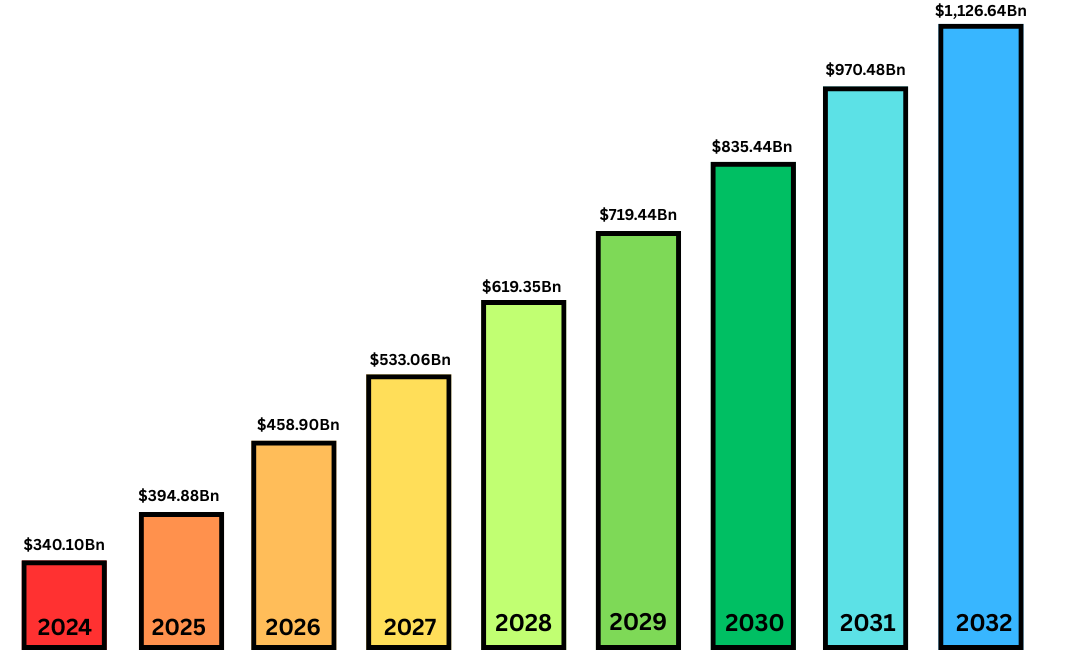

According to a report by Fortune Business Insights, the global market cap of the fintech industry was $340.10 billion in 2024 and is expected to reach $394.88 billion in 2025. With a CAGR of 16.2%, the market cap is expected to reach $1,126.64 billion in 2032.

Types of Fintech Apps

[1] Payments Apps

These are one of the most widely used types of fintech apps. These applications are used to easily transfer money from one bank account to another and also perform tasks such as paying bills, shopping online, etc. These apps also support QR codes that can be scanned by the camera of the device and make it seamless to initiate transactions anywhere.

[2] Lending Apps

Lending apps are used to get an instant loan without any collateral or document work. They offer personal loans, education loans, payday advances, or business-related funding.

[3] Personal Finance Apps

Many people keep track of their finances and maintain a budget. Personal finance apps are crafted for these kinds of users to help them track their finances, expenses, create a budget, and gain useful insights in the form of charts and tables to make better decisions.

[4] Stock Trading and Investment Applications

These apps offer various investment options such as stocks and mutual funds. Users can get access to tools for buying and selling stocks, mutual funds, and ETFs. Users can also analyze market trends and look for better investment opportunities with Stock Trading App Development.

[5] Insurance Apps

Insurance applications make the process of buying, managing, and comparing various insurance policies easy. Users can also file claims and renew policies, etc.

[6] Banking Applications

As the name suggests, banking apps are used to perform traditional banking services and operations easily without going to the bank, such as money transfer and paying bills etc.

[7] Cryptocurrency Apps

Cryptocurrency Exchange Development Services enable users to invest in cryptocurrencies. These apps use blockchain technology to securely process your transactions. Users can buy, sell, and compare cryptocurrencies easily.

Advantages of Having a Fintech App for Your Business

[1] Improved Accessibility

Every user loves accessibility, and mobile applications are meant to fulfill the demand. Fintech apps offer a diverse range of features and functionalities that enable users to perform numerous finance-related tasks without going anywhere.

[2] Enhanced Efficiency

Using artificial intelligence and machine learning algorithms, fintech apps can automate tasks such as monthly bill payment, invoice generation, and finance tracking, etc and also reduce errors. This enables the businesses to focus on core operations rather than manual tasks.

[3] Cost Savings

Using automation, fintech applications can greatly reduce the operational costs of a business by minimizing labor and overhead expenses etc.

[4] Data Insights

Fintech apps generate a lot of data. Businesses can leverage this data by gaining insights and important KPIs, thus leading to better data-driven decisions related to business and improving the platform itself.

[5] Customer Trust

The customer is the highest priority of any business. By offering accessibility and advanced features in their fintech apps, such as secure payments, easy loan approvals, and customized financial solutions, customers gain your app’s trust, which is crucial for developing long-term relationships.

Popular Features of Fintech Applications

[01] Multi-Layered Security

Fintech apps are known for robust security measures such as end-to-end data encryption, 2-factor authentication, biometric login, and signature, and more.

[02] Seamless Payments

These apps enable secure and encrypted transactions, which is crucial for the safety of the user data and the app itself.

[03] Smart Budgeting Tools

Users can easily create and manage their budget with sophisticated tools such as goal tracking, financial insights, bill payment reminders, etc.

[04] Investment Management

Users can easily manage their stocks and mutual funds and keep track on the market trends for better opportunities and risk management.

[05] AI-Powered Personal Finance Assistant

Using AI and ML tools, users can get personalized recommendations and suggestions from a dedicated AI chatbot in the app.

[06] Credit Score Monitoring

Users can effectively monitor their credit score to improve credit management, detect and prevent any fraud, prevent identity theft, and much more.

[07] Multi-Currency Support

Since a fintech app covers a wider range of audiences in different countries, it is essential to offer multicurrency support in the app so everyone can use it irrespective of the country.

[08] Rewards & Loyalty Programs

Just like any other app, there are loyalty and reward programs for its users. It allows better user engagement and retention, enhanced brand loyalty, revenue growth, get a competitive edge in the market, etc.

[09] Customer Support & Chatbots

In fintech apps, customer support and an AI chatbot are very important for resolving user queries. It offers several benefits such as instant responses, 24/7 availability, personalized assistance, etc.

[10] Intuitive User Interface (UI)

The user interface is the part of the app that is visible to the user, and it gives the app a unique identity. It improves user engagement, ease of navigation, reduces errors, faster transactions, etc.

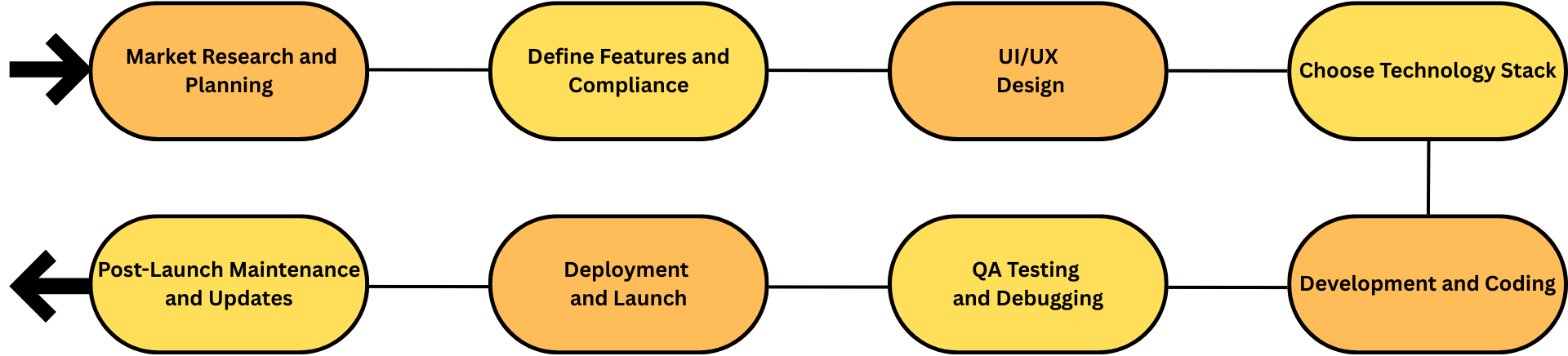

Fintech App Development Process

Stage 1: Market Research and Planning

Every successful app development process begins with extensive market research and planning. In this stage, the team understands your target audience, analyzes the competitors, and identifies the market gaps. The team focuses on providing a reliable and unique solution that focuses on the customer’s pain points. In this stage as well, it is important to select the monetization model of the app and define the app’s goals and objectives. Then, develop a detailed roadmap that includes the project milestones, technology stack selection, etc.

Stage 2: Define Features and Compliance

In the second stage, the features and functionalities of the fintech app are defined. Features such as payment gateways, real-time fraud detection, personalized financial advice, etc, should be developed and integrated while keeping the user at the center of focus. Ensure to comply with financial regulations such as PCI DSS, GDPR, etc, to avoid any legal issues. Also, plan for scalability and upgradability as soon as possible.

Stage 3: UI/UX Design

Focus on creating a user interface that is engaging and offers seamless navigation across the application. A well-designed UI/UX enables even a simple user to easily navigate through the app and execute transactions at a much faster speed. Also, a good user experience (UX) ensures the user gets a seamless and enjoyable journey. This helps to increase the user retention on the app and encourages them to return to the app.

Stage 4: Choose Technology Stack

Selecting the right tech stack is important as it determines the performance and scalability of your mobile app. You can select a native app or a cross-platform application. For native app development, you can select React Native, and for cross-platform, Flutter is a great option. Databases such as MongoDB and PostgreSQL are good for storing data. This stage also involves selecting the right API, such as payment gateways, etc, to integrate into the app.

Stage 5: Development and Coding

Now this is the main part of the app development process. You can start by creating a Minimum Viable Product (MVP) while focusing on developing the core features and functionalities first. An MVP enables the early testing of the application and gets feedback to improve it further. Incorporate Agile methodology to ensure adaptability to sudden changes in the project requirements. Follow the project roadmap for step-by-step completion of each module on time.

Stage 6: QA Testing and Debugging

After the app is developed, it is time to test it under simulated real-world situations. Various test cases are prepared, and testing such as unit, integration, usability, security, functional, non-functional, etc, is performed to check the application on various aspects. Continuous debugging and testing at this stage would save a lot of cost for fixing the app after deployment and launch.

Stage 7: Deployment and Launch

Now that the app is tested, it is ready for deployment on various platforms such as Android, iOS, and web. App Store Optimization ensures the app is suitable and meets the guidelines to be deployed on the respective app store. Also, marketing and promotional campaigns should be launched to advertise the app and its features to a wider audience.

Stage 8: Post-Launch Maintenance and Updates

Every application needs regular maintenance to keep it fine and running for a long time. The user feedback plays a crucial role by helping the developers fix and improve the app. Monthly updates are provided that give the app new features and functionalities that ensure the app remains updated with the latest market trends and fulfills the user’s needs.

Use a Future Ready Tech Stack for Fintech App Development

[1] Frontend Development

{1} Native Development

- Android: Kotlin, Jetpack Compose.

- iOS: Swift, SwiftUI.

{2} Cross-Platform Development: Flutter, Dart, React Native, JavaScript.

[2] Backend Development

- Languages and Frameworks: Python, Django, Flask, Java, Springboot, Node.js.

- Database: PostgreSQL, MySQL, SQL Server, MongoDB, Apache Cassandra, Couchbase, Redis, Memcached.

- Streaming: Apache Kafka.

[3] Security: AES, RSA, OAuth, JWT, PCI DSS, GDPR.

[4] Payment Gateway: Razorpay, Stripe, PayPal.

[5] Cloud: AWS, Azure, GCP.

[6] DevOps: Kubernetes, Docker, Jenkins, GitLab CI/CD.

[7] IDEs: Android Studio, VS Code, Visual Studio, XCode, PyCharm, IntelliJ IDEA.

Integration of Latest Technologies in Fintech Applications

[1] Artificial Intelligence and Machine Learning

AI and ML are one of the latest and emerging technologies in the world. AI and ML are widely integrated into fintech applications that offer many features and advantages, such as hyper-personalization, predictive data analytics, fraud detection, etc. These technologies help in analyzing user patterns and transaction patterns in real-time and offer customized financial advice and risk management solutions. AI-based chatbots offer enhanced customer support and user satisfaction.

[2] Blockchain

Blockchain can be considered the core of fintech applications. Using blockchain ensures transparency, security, and efficiency in every transaction and also reduces the risk of fraud and data breaches by creating several immutable records of transactions. It also offers faster cross-border payments and lower transaction fees.

[3] Biometric Authentication

It is one of the most widely used technologies in smart devices and fintech apps. Biometric authentication uses the user’s unique fingerprint or voice to execute transactions within the app and also to secure the app from unwanted access. This minimizes the risk of fraud and unauthorized access.

The Cost to Develop a Fintech App in 2025

The fintech app development cost in 2025 depends on several important factors such as:

[1] App Size and Complexity

The size of the app and its complexity are correlated with each other. A basic app with features such as payment processing and account management will cost less to develop as compared to an app with complex features such as AI/ML analytics, blockchain integration, multi-currency support, etc. The more the features, the longer it would take to develop, and hence the higher the resource cost.

[2] Development Team Size and Location

The development team size is determined by the app size and complexity. If the app is basic to medium-sized, the team size will be smaller, and hence the delivery time will be accordingly. If the app is complex, the team size will be large, and thus the overall development cost will vary accordingly. The location of the team also matters a lot. The team situated in the USA would charge more than a team in India or Malaysia.

[3] Maintenance and Updates

The app requires regular maintenance, which is non-negotiable. The app size and complexity would determine its maintenance cost. Updating compliance and regulations to fix the bugs and errors requires a significant investment. Also, the market keeps changing, and new features and functionalities are required to keep the app running for a long time and ensure the user retention rate never drops.

[4] Technology Stack

There are multiple tech stacks available in the market. Integrating the latest technologies, such as artificial intelligence and machine learning, and blockchain, is expensive to develop and integrate, and increases the overall app development cost. Also, cloud solutions require subscription or licensing fees, which add up to the cost too developing a fintech app.

[5] UI/UX Design

An intuitive and appealing user interface and user experience determine the success or failure of the app. Creating custom animations, responsive designs, and accessibility features adds up to the overall cost but increases the overall appearance and look of the app in the long run.

Basic App: $5,000 to $25,000.

Medium-Complexity App: $25,000 to $70,000.

High-Complexity App: $70,000 to $110,000 or more, depending on the complexity and features.

How to Select a Fintech Mobile App Development Company?

Choosing the right fintech mobile app development company is a crucial decision as it determines the quality of the app for your investment. There are several steps that you need to follow. First of all, evaluate the company by looking at its portfolio of diverse projects and checking its success rate. Check its other important details, such as its knowledge and expertise in developing fintech solutions, its understanding of various regulations, security protocols, and legal compliance. Moreover, check whether they offer on-time delivery of the project, follow a client-centric approach, create clear project milestones, and also perform end-to-end and transparent communication with the client. One such company is Next Olive, which is a reliable fintech app development company that provides cutting-edge fintech app development services in over 20 countries, such as the USA, UK, UAE, Australia, Saudi Arabia, Israel, etc. It has over 13 years of experience working in the fintech industry and has over 200 experienced fintech app developers. You can connect with them to get the best quality product for your time and investment.

Conclusion

In conclusion, developing a fintech app is a long and complex process that requires expertise and knowledge. We uncovered various factors that influence the development of the app and got to know the cost to develop a fintech app. We learned how to select a development team or a firm, and most importantly, the advantages of having a fintech application for your business.

Frequently asked questions (FAQs)

What are some financial app development companies that offer fintech app solutions near me?

Several companies provide fintech app solutions such as:

- Next Olive Technologies

- Appinventiv

- Apptunix

- Rishabh Software

How Agile model differ from the Waterfall model?

Agile model is used in projects where requirements are variable and might change or be altered suddenly. The waterfall model is used in projects where the project requirements are fixed and do not require frequent alterations.

What are some key features of a fintech application?

Fintech apps have many essential features such as user authentication, account management, payment processing, transaction history, push notifications, etc.

How long does it take to develop a fintech app?

The time required to develop a fintech app depends upon several factors such as size, type, and complexity of the app. Generally, it is about 2 to 3 months for a basic app, 4 to 6 months for a medium-sized app, and 6 to over 10 months for a complex app.

0 Comments