Fintech App Development Cost (2025)

How Much Does It Cost to Develop a Fintech App?

Fintech apps have transformed how people perform finance-related tasks using just their mobile devices. Many businesses are getting into the fintech industry and wonder about the fintech app development cost in 2025. This comprehensive guide is for individuals or businesses who want to develop either a banking app or a personal finance tracker. This guide covers all the necessary elements involved in fintech mobile app development cost, such as the type of app, size, and complexity, etc, and helps you in allocating your budget and resources effectively and make informed decisions.

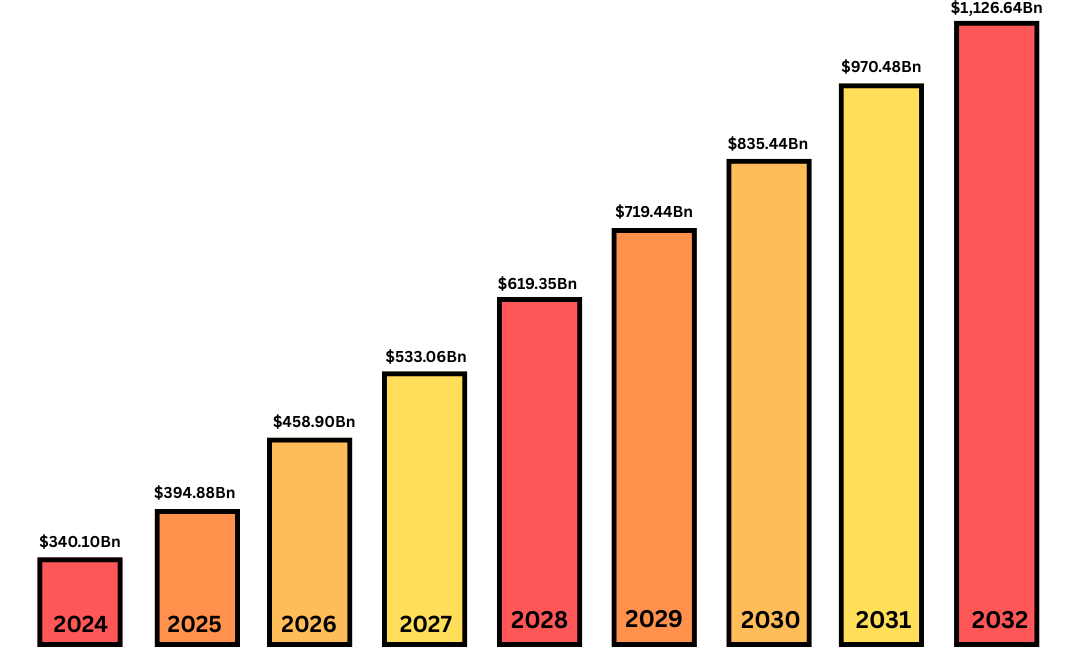

Market Statistics of Fintech App Development in 2025

As per a report by Fortune Business Insights, the global market cap of the fintech industry was $340.10 billion in 2024 and is expected to reach $394.88 billion in 2025. With a CAGR of 16.2%, the global market cap is expected to reach $1,126.64 billion in 2032.

Fintech App Development Cost Based on Type of App

[1] Payments Applications

Payment applications have become popular after the COVID-19 pandemic, These are highly versatile apps that offer a cashless and contactless payment facility to users, such as sending and receiving money etc. These apps have many features such as QR code scanning, fraud detection, multicurrency support, etc. Cost Estimate: $20,000 to $80,000.

[2] Lending Applications

Lending applications are used to get quick loans without lengthy documentation for collateral, etc. These apps offer a variety of loan options, such as an education loan, a home loan, a business loan, etc. Lending apps come with many features, such as a loan calculator, credit score analysis, repayment reminders, etc. Cost Estimate: $40,000 to $110,000.

[3] Personal Finance Apps

As the name suggests, personal finance applications offer various tools for users to manage their finances and personal budgets easily. These apps include many essential features and functionalities such as budget planners, real-time expense tracking, financial insights and analytics, savings goal tracker, etc. Cost Estimate: $50,000 to $100,000.

[4] Investment Applications

Investment apps and stock trading apps such as Groww, Binance, and Fisdom enable users to buy, sell, and manage stocks, mutual funds, ETFs, etc. Users can easily analyze the market trends, manage their investments and portfolio, etc. These apps have features such as portfolio management, AI-powered recommendations, real-time market trend analysis, etc. Cost to Develop: $60,000 to $150,000.

[5] Insurance Applications

Insurance apps are used to buy and compare various insurance policies easily. These applications contain features such as policy comparison tools, payment reminders, claims submission, document management, renewal notifications, etc. Estimated Cost to Develop: $80,000 to $200,000 or more.

[6] Banking Apps

Banking apps have redefined how users perform banking-related tasks without even visiting the bank. These apps enable users to easily transfer funds from one account to another, pay bills, and review their transaction history with ease. Banking apps have several features, such as biometric authentication, secure transactions, fraud detection, and much more. Cost Estimate: $15,000 to $60,000.

[7] Cryptocurrency Applications

Cryptocurrency is the latest form of digital currency based on blockchain technology. These applications enable secure managing, storing, and trading of cryptocurrencies. There are many features in these apps, such as secure digital crypto wallets, blockchain integration, trading features, real-time price tracking and analysis, multi-layer encryption, etc. Estimated Cost to Develop: $70,000 to over $200,000.

Essential Features and Their Integration Cost in Fintech Apps

[1] User Registration, Profile Creation, and KYC

Users can create their profile and update their KYC details, verify identity, and upload documents etc. Cost: $4,000 to $15,000.

[2] Bank Account Linking

Easily and securely link the user’s bank account with the application. Cost: $5,000 to $12,000.

[3] Digital Wallet Integration

In-app wallet enables users to store, receive, and send funds. Cost: $6,000 to $20,000.

[4] Payment Gateway

Users can securely pay using the app via UPI, cards, net banking, etc. Cost: $5,000 to $15,000.

[5] Fund Transfer

Users can send money to other users via contact number or by scanning a QR code on the other user’s device. Cost: $4,500 to $12,000.

[6] Transaction History

Users can view their detailed logs and transaction history, and can export them as well for further analysis. Cost: $3,000 to $9,000.

[7] Expense Tracker

Enable the users to keep track of their expenses and maintain a budget using budgeting tools. Cost: $5,500 to $14,000.

[8] Push Notifications

Provide timely alerts to users of any new information and offers. Cost: $2,000 to $5,000.

[9] Investment Options

Offer various investment options such as stocks, mutual funds, crypto, ETFs, etc. Cost: $11,000 to $30,000.

[10] Loan Module

Provides loan applications, EMI calculator, credit score integration, etc. Cost: $7,000 to $20,000.

[11] AI Chatbot and Customer Support

AI/ML-powered chatbots and customer support allow users to resolve their queries easily. Cost: $3,500 to $10,000.

[12] Security and Data Encryption

Offer end-to-end encryption, 2FA, biometric login, etc, for robust security in the app. Cost: $5,000 to $20,000.

[13] Admin Panel

App owner-side panel to manage the app, users, permissions, transactions, etc. Cost: $5,000 to $12,000.

[14] Data Analytics

Easily analyze the market trends, user behavior, and important KPIs using analytical tools. Cost: $3,500 to $11,000.

[15] Reward Programs and Referrals

Offer cashback, reward points, loyalty programs, etc, to drive user engagement and increase user retention. Cost: $3,000 to $8,000.

[16] Multilingual and Multicurrency Support

Users can select the desired language and the currency according to their region and country. Cost: $2,000 to $6,000.

[17] Biometric Authentication

Enable fingerprint scanning, voice recognition, etc, for safe and secure transactions. Cost: $2,500 to $5,000.

[18] Third-Party Integrations

Third-party APIs for payment gateway, GST verification, credit score checks, etc. Cost: $3,000 to $8,000 per API.

Factors That Affect Fintech App Development Cost

[1] App Size and Complexity

When it comes to determining the cost of fintech app development, app size and complexity play a vital role. A simple app with basic features costs less compared to an app with highly complex features, such as AI/ML integration and blockchain. The more complex the app is, the more it will cost. But, analyzing the current market trends, these features are a boon to the users and would justify the cost.

[2] Platform Selection

There are many platforms available to choose from, such as Android, iOS, and Web. There are mainly 2 types of development: native and cross-platform. Native app development focuses on developing the app for a single platform, but it costs more resources and time, hence it is costly. Cross-platform development aims at developing a single app for multiple platforms using a single codebase. It is less costly compared to native apps.

[3] Development Team

The development team plays an important role in deciding the cost to develop a fintech app. The team size would be small or large, depending on the project size. The bigger the team, the higher the cost to hire them. Also, if the team is situated in the USA or UK, the hiring rates would be more than the team based in India or Malaysia.

[4] UI/UX Design

The complexity of the user interface and user experience also plays an important role in determining the overall cost. A simple UI with basic animations would generally cost less. But adding custom and complex animations, smooth navigation, interactive elements, and accessibility further increases the overall development costs.

[5] Third-Party Integrations

Third-party integrations add new features and increase the overall functionality of the fintech apps. APIs such as payment gateway, data analytics tools, etc, require licensing fees and are generally less costly to integrate than developing and integrating a custom API from scratch.

[6] Maintenance and Updates

Regular maintenance and updates help keep the fintech application running for a long time without any issues. Regular bug fixes, security updates, and feature enhancements are crucial to keeping the app relevant in the market. Maintenance is an ongoing process until the app’s end, and the prices vary according to the app’s size and complexity.

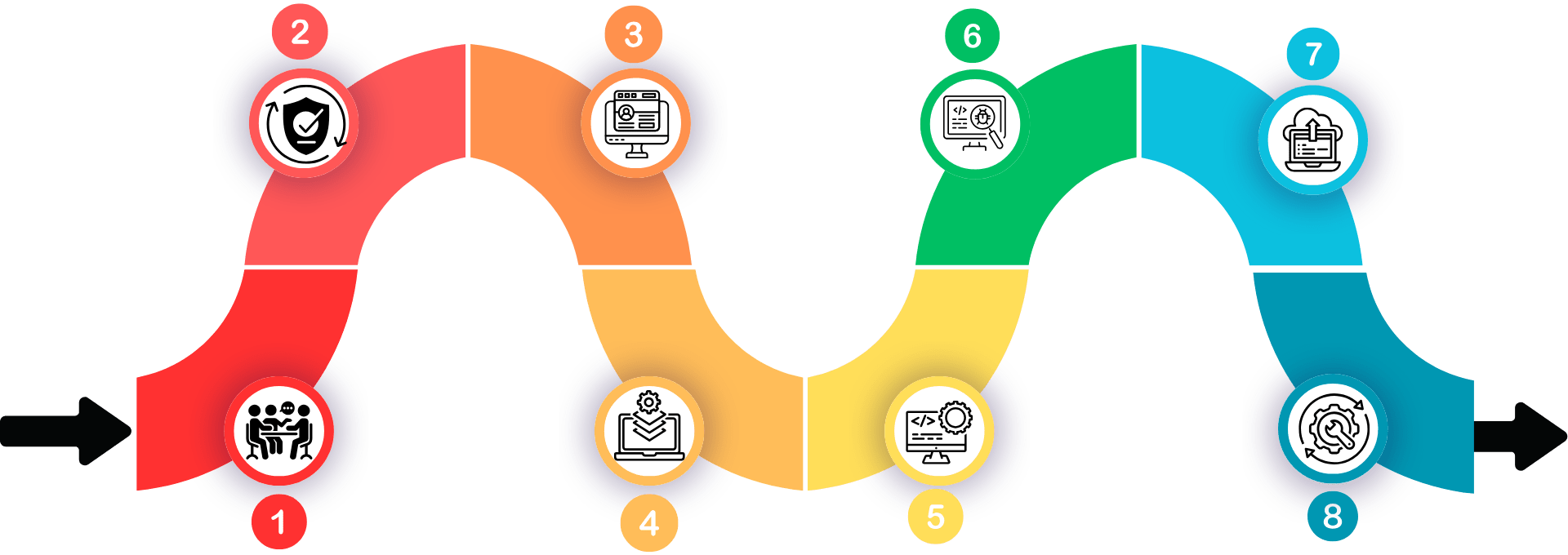

Follow a Step-by-Step Fintech App Development Process

[1] Market Research and Planning

In the first stage, market research relevant to your fintech app idea is conducted. Conduct competitor analysis, analyze your target audience, and current industry trends for understanding user needs and gaps. After this step, create a comprehensive project plan that highlights the project goals, project milestones, tech stack, selecting development methodology, etc. This ensures that the project is aligned with the market trends and demand, which ensures success. Cost Estimate: $3,000 to $10,000 or more.

[2] Define Features and Compliance

After the project plan is made, the features and requirements of the app are discussed. Decide important functionalities such as payment gateway, investment management, expense tracking, 2-factor authentication, etc. Also, ensure your app meets necessary legal and regulatory compliance, such as GDPR, PCI-DSS, etc. Compliance is necessary as it develops trust among users and prevents any future legal issues. Estimated Cost: $5,000 to $15,000 or more.

[3] UI/UX Design

UI/UX determines the success or failure of your app to an extent. Because a bad UI will not allow the users to stay on the app for a longer time. So it is important to design and develop UI/UX keeping the users at the center of focus. Create a highly responsive, intuitive, and user-friendly user interface that also ensures accessibility to users. Cost Estimate: $10,000 to $20,000 or more.

[4] Choose Technology Stack

Select the right tech stack that ensures your app is secure, stable, reliable, and efficient. In the case of fintech apps, select the technologies that support real-time data processing, secure encryption, and cross-platform compatibility. A powerful backend is the backbone of your overall app. Cost: $5,000 to $12,000.

[5] Development and Coding

This is the main part of the whole app development process. Developers start to create the frontend and backend of the app using the selected technologies. A strong collaboration is required between the designers and developers to ensure consistency in the project development process. Incorporate unit testing to check individual modules for any issues. Development Cost: $10,000 to over $50,000.

[6] QA Testing and Debugging

After the application is fully developed, it is time to test it in a simulated environment. Proper testing ensures your app works fine without any bugs and issues, and the performance remains at the top. Several testing methods, such as integration, usability, acceptance, functional, non-functional, etc, are performed using various test cases to test various aspects of the app. Testing Cost Estimate: $5,000 to $15,000.

[7] Deployment and Launch

This stage marks the end of the testing stage and the beginning of the launch of the app in the market. The app is submitted to the Play Store or App Store for review. Once the app has been reviewed, it is launched and promoted extensively through marketing campaigns to reach a wider audience. Deployment Cost: $4,000 to $10,000 or more, depending on the marketing budget, etc.

[8] Post-Launch Maintenance and Updates

Regular maintenance and updates are required to keep the fintech app running and relevant. Providing regular updates, implementing user feedback, and security patches ensures a high-quality user experience and user retention. Deployment Cost: $5,000 to $15,000 Annually.

Use a Future-Ready Tech Stack in Fintech App Development

[1] Frontend Development

{1} Native Development

- Android: Kotlin, Jetpack Compose.

- iOS: Swift, SwiftUI.

{2} Cross-Platform Development: Flutter, Dart, React Native, JavaScript.

[2] Backend Development

- Languages and Frameworks: Python, Django, Flask, Java, Springboot, Node.js.

- Database: PostgreSQL, MySQL, SQL Server, MongoDB, Apache Cassandra, Couchbase, Redis, Memcached.

- Streaming: Apache Kafka.

[3] Security: AES, RSA, OAuth, JWT, PCI DSS, GDPR.

[4] Payment Gateway: Razorpay, Stripe, PayPal.

[5] Cloud: AWS, Azure, GCP.

[6] DevOps: Kubernetes, Docker, Jenkins, GitLab CI/CD.

[7] IDEs: Android Studio, VS Code, Visual Studio, XCode, PyCharm, IntelliJ IDEA.

Monetization Strategies of Fintech Apps

[1] Subscription Fees

In this model, you can offer advanced features at a premium, such as advanced analytical tools, in-depth financial insights to the user on a monthly or annual subscription plan.

[2] Transaction Fees

In this model, you can charge a small amount from the user on each transaction that is executed in the app. Although the amount would be small, it is beneficial in the long run.

[3] Advertisements

You can connect with companies and brands of your niche and offer them ad slots in your fintech app. The companies can run their ads for products and services, and you charge them money for that.

[4] Freemium Model

This is one of the most widely used monetization models. In this model, you offer the app with basic features to use free of cost, while charging a premium for more advanced features and functionalities.

[5] In-App Purchases

You can provide additional features and functionalities in your app, such as educational resources, financial courses, etc, on a one-time purchase.

[6] Partnership Programs

You can collaborate with financial firms such as banks and investment companies to offer their exclusive services and integrations in your app in exchange for money.

How to Optimize Fintech App Development Cost in 2025?

[1] Set Clear Requirements Early

Before the development of the app begins, set clear goals and requirements as early as possible. It helps to avoid any confusion, and developers can focus on the essential aspects of fintech apps.

[2] Leverage Third-Party APIs

Use third-party APIs and tools as they require licensing fees, which is comparatively less costly than designing and developing the whole API from scratch.

[3] Use Cross-Platform Development

Cross-platform development focuses on using a single codebase for developing the app for multiple platforms at once. This saves a lot of time and resources to develop the same app for individual platforms.

[4] Utilize Cloud Platforms For Scalability

Cloud platforms come with subscription fees that are lower than developing the hardware infrastructure for storing your application, and it is also cost-effective when it comes to upgrading the app in the future.

How Next Olive Can Help You in Fintech App Development?

Next Olive is the leading fintech app development company with over a decade of experience in delivering fintech app solutions to clients in over 20 countries, such as the USA, UK, Australia, Israel, UAE, etc. The company has a record of delivering exceptional results in the given period while having a client-centric approach. Also, the firm has over 100 fintech app developers who set clear goals and project milestones before starting the development. You can contact Next Olive for developing cutting-edge fintech app development Services for your business.

Conclusion

In conclusion, the fintech app development cost depends on various factors such as the type, size, complexity, platform selection, etc. The development team size and location also play an important role in determining the overall cost. You can hire a freelancer or a full-fledged development team. Moreover, opting for a fintech mobile app development company is a better choice as it would give the best value for your budget and time.

Frequently asked questions (FAQs)

What are some of the best financial app development companies near me?

Some of the top fintech app development companies are:

- Next Olive Technologies

- Apptunix

- Appinventiv

- Ripenapps

What is the difference between a payment app and a banking app?

A payment app is mainly used to transfer funds from one bank account to another via scanning a QR code or mobile number. Whereas, a banking app is used to do various types of bank-related tasks such as fund transfer, bill payment, etc.

How much time does it take to develop a fintech application?

The time required to develop a fintech app depends on several factors such as size, type, and complexity of the app, as well as the platform the app will be developed for:

- Basic App: 2 to 3 Months.

- Medium-Complexity App: 3 to 6 Months.

- High-Complexity App: 6 to Over 12 Months.

How long does it take to develop a fintech app?

The time required to develop a fintech app depends upon several factors such as size, type, and complexity of the app. Generally, it is about 2 to 3 months for a basic app, 4 to 6 months for a medium-sized app, and 6 to over 10 months for a complex app.

0 Comments